Looking for something else?

Welcome

Our 2022 Outlook was titled, “A Year for Reasonable Expectations,” but the developments of the year turned quickly into something much more severe. As we move into 2023, there remains a wide range of forecasts – some still calling for severe recession while others cautiously upbeat. We believe that 2023 will see the markets and the economy recalibrating, which may be a bumpy process but that will ultimately achieve a soft landing. In 2023, the return profile for both bonds and equities should be more aligned with historical norms, which guide toward mid-single-digit returns for a relatively safe bond portfolio and high single-digit or greater returns for an equity portfolio.

The Case for a Soft Landing

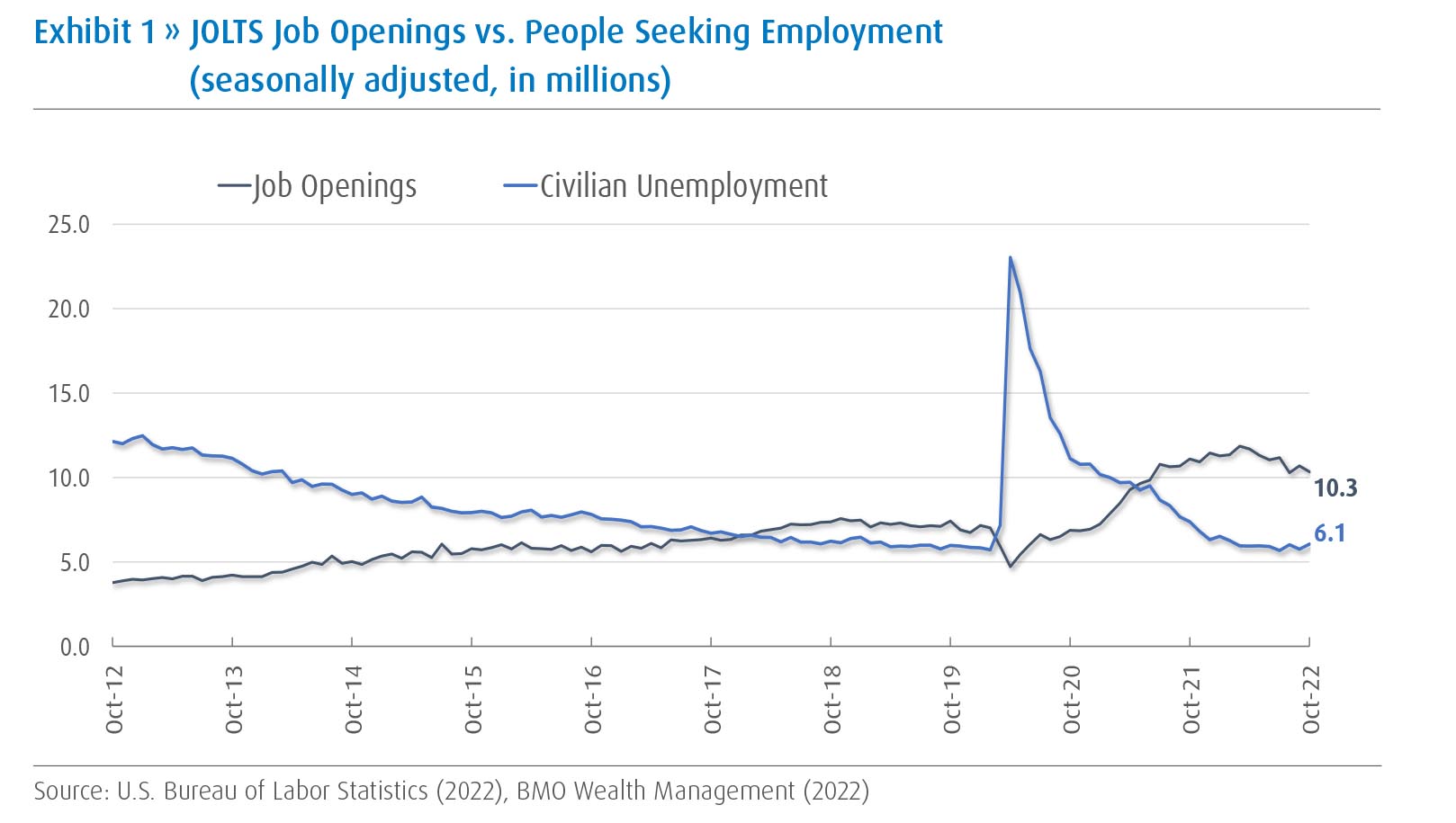

The underpinning of a soft landing for the U.S. economy rests with a labor market that is easing at the margins but remains fundamentally healthy. Even amid the sharply rising interest rates of the past year, job creation has remained healthy, weekly initial unemployment claims low, wage growth well above average, and the number of job openings towers above the number of people seeking work (Exhibit 1). While the month of November saw a spike in layoffs, this increase was entirely driven by the technology sector and layoffs elsewhere remained muted.

The dynamics of a soft landing entail a slowdown that stabilizes after a few quarters rather than builds momentum to the downside. It could involve a mild recession, but the most fundamental distinction is between a soft landing and hard landing rather than recession/no recession. At present, the Conference Board’s model of recession predicting “Leading Indicators” is causing concern among some market forecasters due to its steep decline. Evaluating the drivers of that decline, however, shows that over half of the drop in the aggregate measure comes from “Consumer Expectations,” which our own analysis finds to be a very unreliable indicator. At the end of the day, we believe that if people have jobs and feel reasonably comfortable in their jobs, their spending will continue to support the economy.

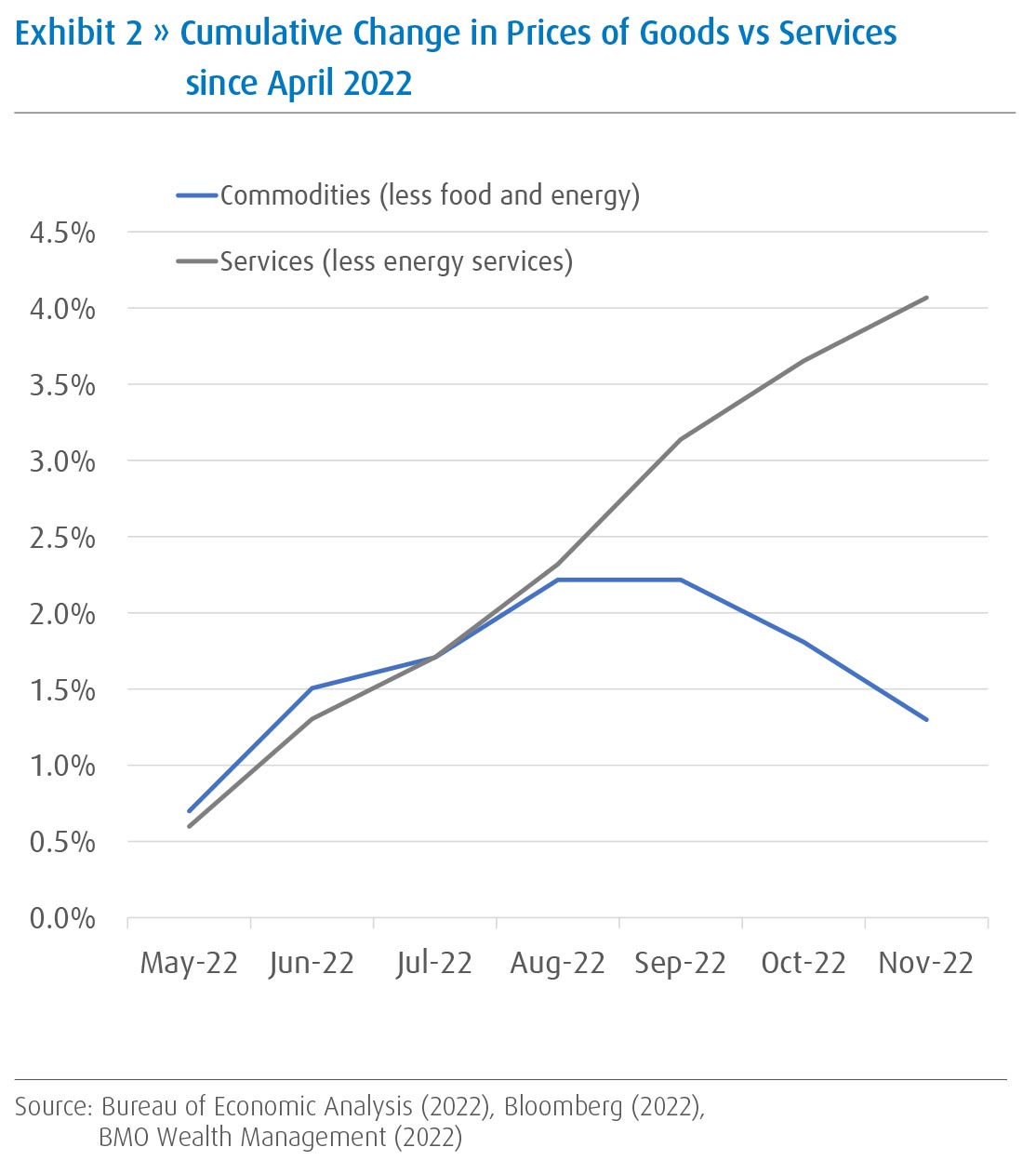

On the inflation front, goods inflation is indeed coming down, but we expect services inflation to remain sticky for some time and fall more gradually (Exhibit 2). On net, however, inflation should continue to soften and allow for the Fed to take a more balanced approach, which is conducive to the recalibration process. While unlikely, there remains risk that inflation in the service sector along with wage growth remain stubbornly high and compel the Fed to push ahead with another round of rate hikes in mid-2023.

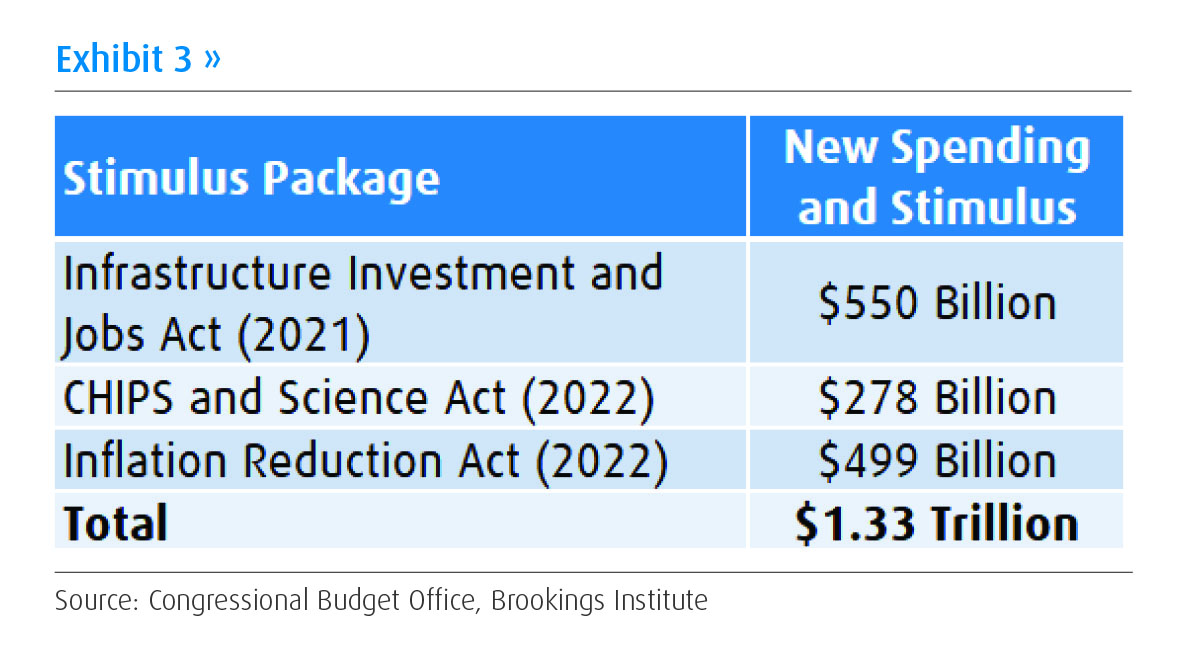

Finally, the impact of recent major spending bills – the Infrastructure Investment and Jobs Act, the CHIPS and Science Act, and the Inflation Reduction Act – will support economic growth in 2023 (Exhibit 3). Longer-term trends of on-shoring and supply-chain restructuring will similarly play into what we believe will be a manufacturing renaissance over the coming years.

What Does Recalibrating Look Like?

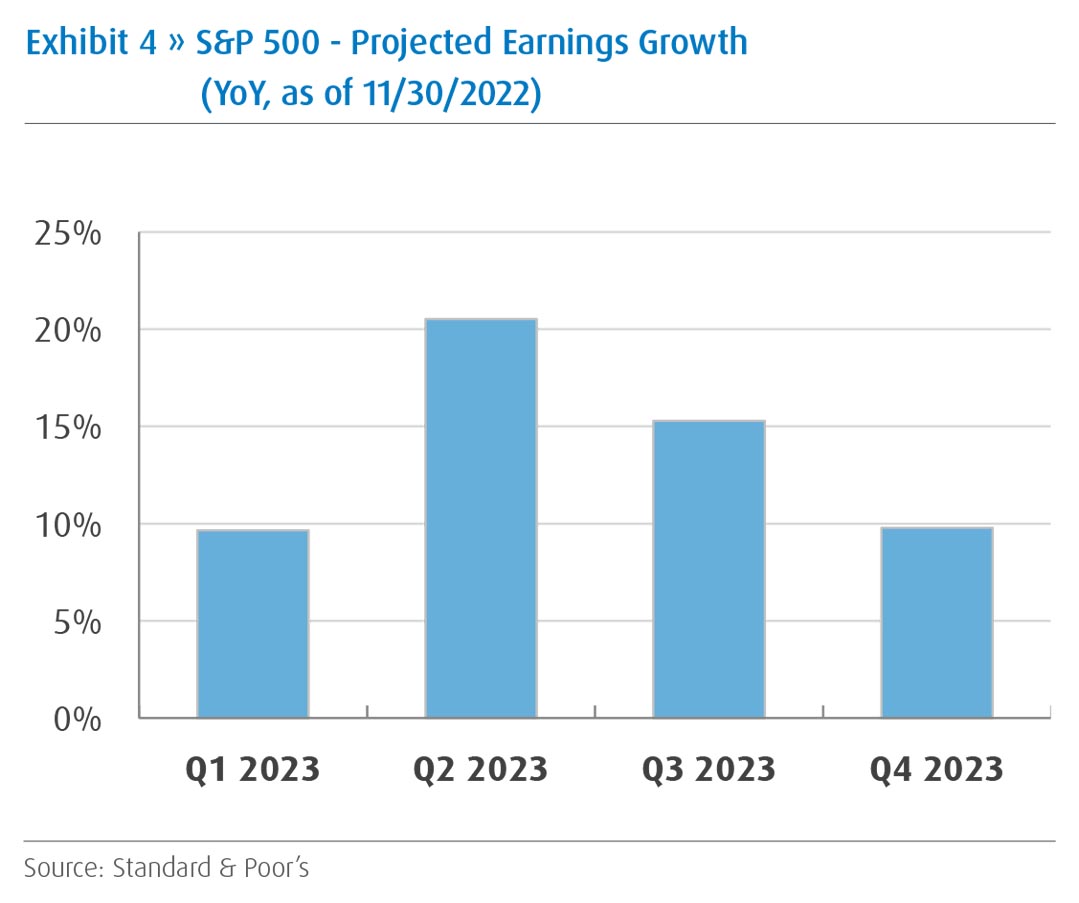

We do expect some slowdown in the U.S. economy and cuts to earnings estimates early in the year as the impact of higher interest rates slows economic activity. Over the past year, companies in aggregate experienced profit margin pressure as sales growth far exceeded earnings growth. Cost pressures are likely to linger for another couple of quarters and continue to pressure margins and lead to cuts in the current estimates of future earnings (Exhibit 4). As the economy recalibrates in 2023, however, we expect these cost pressures to abate by mid-year and allow for a more stable and predictable earnings environment. By year end, corporate earnings growth should resume a trend that is closer to growth in revenues in the high single digits. In this scenario, moderate inflation that is passed on to consumers adds to earnings growth.

Equity Market Considerations – the U.S. and International

The stock market is both forward looking and prone to overshoot in both directions. Our base case is that choppy markets persist until enough signs of a successful soft landing and recalibration have appeared. Those signs primarily consist of labor market stability, moderating inflation, and stabilization in earnings estimates. The U.S. markets provide more stability and lower risk, while both international developed and emerging market equities entail greater risk but also more potential upside if positive developments accelerate. For now, we prefer the greater stability and risk mitigation that we believe U.S. markets provide.

In particular, China’s reopening and moving away from its “Zero Covid” policy carries two-sided risk. A health crisis could lead to instability and unexpected economic consequences, but the prospect of a full reopening once health concerns are less acute could add to global inflationary pressures. Despite these risks, we believe the most likely scenario is one in which China contributes more positively to global growth in 2023 but does not accelerate so much as to reignite inflation pressures

Interest Rates, Fixed Income, the Dreaded Yield Curve Inversion

It has been a dramatic shift over the past year with short-term interest rates going from zero to begin the year to around 4.5% at year end. We expect the Fed to continue to slow its interest rate increases and pause somewhere near the 5% level on the short-term Fed Funds rate and then allow this level to prevail for potentially all of 2023. We also believe that longer-term yields are likely to rise as a soft landing materializes and the Fed holds short-term interest rates steady, which could bring the yield on the 10-year Treasury Note back above 4%.

Currently, the 10-year Treasury yield looks set to finish 2022 well below short-term interest rates, creating what is known as an “inverted yield curve.” Such yield curve inversion has a stellar track record for predicting future recessions, although the time between yield curve inversion and actual recession has sometimes been quite short and sometime much longer.

Could this be the instance that the inverted yield curve fails to predict a recession? The yield curve has certainly proven to be a useful model when such signals arose in the past, but like all models it has the possibility of failing at some point. The extraordinary circumstances of a global pandemic, unprecedented stimulus and savings, dramatic rise in short-term interest rates, historically strong labor market, spiking and then cooling inflation, and the economic effects of the war in Ukraine present more than enough unique circumstances such that a model failure wouldn’t be surprising. If a recession does occur, we believe it would most likely be brief and mild and not derail our overall outlook or approach to the year.

Positioning, Risks, and Equity Valuation

We enter 2023 recommending a balanced approach to risk overall. We believe that both stock and bonds – including the more credit-sensitive areas of fixed income – will provide returns more commensurate with their longer-term trends. Nonetheless, 2023 will almost certainly have surprises, and hopefully new opportunities.

The two largest risks are stickier service sector inflation that compels the Fed to raise interest rates well beyond what is currently expected in the marketplace, and the possibility of some type of economic shock – such as an oil shock – that either leads to greater inflation or lower growth. Both of these risks we consider unlikely, but certainly not remote possibilities.

Our models indicate that U.S. equities are approximately fairly valued. In 2023, we anticipate relatively stable valuations. That expectation, along with profit margins that bottom out within a couple of quarters, implies that equity returns should roughly align with the trajectory of earnings growth that prevails around year end, which we expect to be in the high single-digit range. It may well be a choppy market in 2023, but we expect it to play out favorably.

Stay on top of the latest news and insights from BMO Wealth Management