Looking for something else?

Welcome

“Life is ten percent what you experience and ninety percent how you respond to it."

- Dorothy M. Neddermeyer

Global markets were roiled last week by inflammatory headlines, rising rates, and mounting fears of spiraling market declines. The Federal Reserve’s “Federal Open Market Committee” (FOMC) meeting minutes released in early January pointed to even greater hawkishness than the market had expected just in December, which was already greater than in prior months. Recent softening of economic data has added to the market’s concern. Amidst the near-term emotion, it’s important to take a deep breath and cast a discerning eye on both on the context of the decline, as well as the fundamental underpinnings and likely path ahead.

Context

US equity markets entered 2022 on a solid note, carrying the prior year’s strong double digit increases into the first few days’ trading.

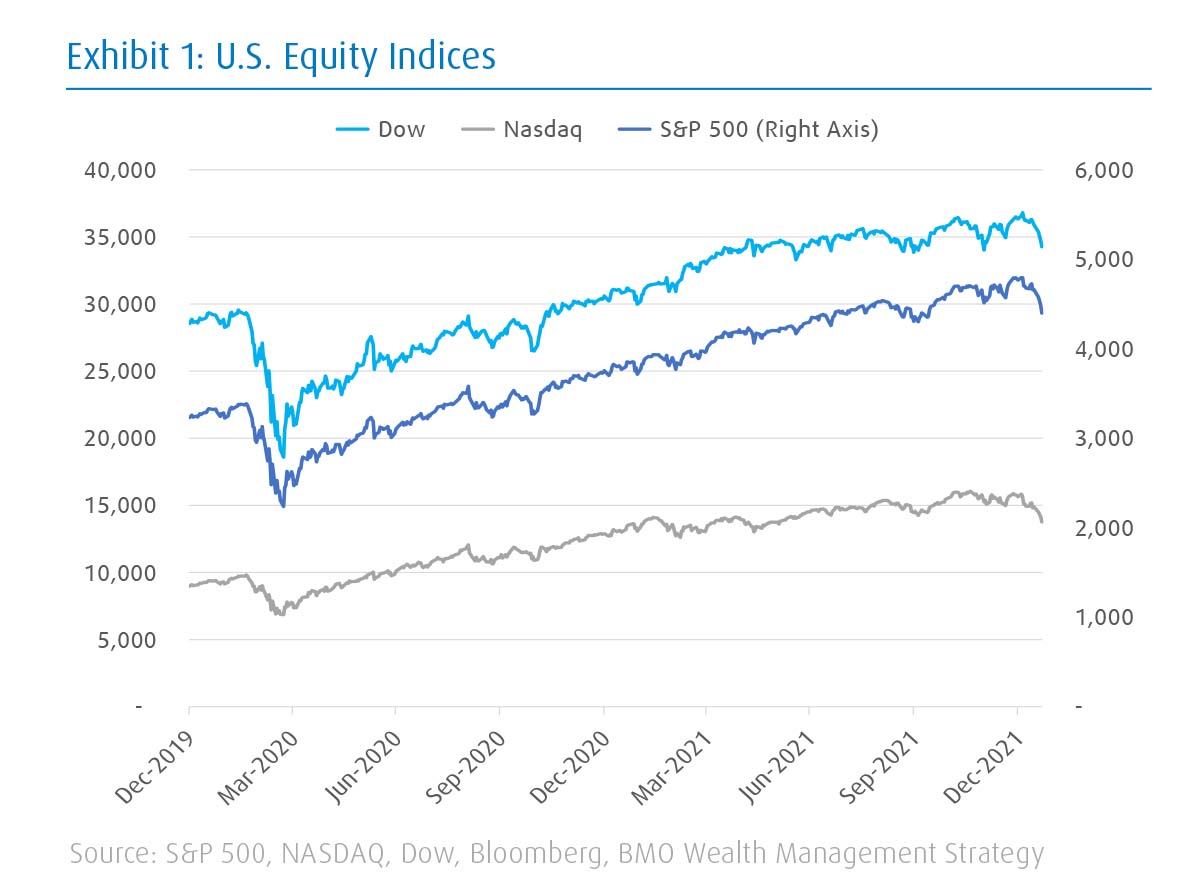

As chart #1 shows domestic blue chips, for example as represented by the S&P 500 are up around 100% from the lows touched during the early pandemic. Notably, last year’s nearly 30% rise came on the back of a similar increase in 2020 – a period of strong performance with no lasting drawdowns. Recent market action could be seen at least in part as a normal pause in a secular trend that has largely been in place since the bottom touched during the Great Financial Crisis in the spring of 2009.

From a fixed income standpoint, it’s worth noting that 10-year treasury yields declined over most of last week, after touching a post-pandemic high of 1.90% last Tuesday. Even more notable, spreads between high-yield bonds and treasury bonds remained tight – rather than widening as would be expected if more dire economic issues were at play (chart #2). This is an important barometer of underlying economic health.

Even the much written about pull back in higher risk assets like technology stocks, cryptocurrencies, health care, SPACs, and meme-stocks seems an arguably overdue “normal” event against a backdrop of massive prior increases. Context and start point matter.

Fundamental backdrop and a path to stabilization

The current environment has also heightened the focus on anything that hints at a slowdown in growth. A small but still surprising rise in unemployment claims last week played into that concern, as did declines in Purchasing Manager Index (PMI) readings and the Chicago Fed’s National Activity Index. In and of themselves, these were not large concerns but in the context of an aggressive Fed and a recent runup in equities the market is taking it as a reason to sell almost indiscriminately.

There is good reason to expect that recent soft economic data will be short-lived and the Fed’s hawkishness – while perhaps not abating – may be peaking as inflation readings soften. The driver of this potential dynamic is a shift in the pandemic narrative as recently signaled by the World Health Organization. In particular, the Omicron variant that has seen rampant spread but less severity and brings hope for “stabilization and normalization.”1 This normalization is already being reflected in policies in Britain which was a few weeks ahead of the U.S. in the Omicron surge and where pandemic restrictions are now being lifted. Such normalization in the U.S. would likely bring a shift back toward services and away from goods and alleviate inflation pressures that already look to be peaking. This, in turn, would allow the Fed to not ramp up – and possibly ramp down – its hawkish tenor.

If this potential path takes hold in the coming months, solid fundamental underpinnings should reassert their importance in the economy and markets. These include:

The week ahead

This week will be full of information for investors in the market to incorporate with both Fed meetings on Tuesday and Wednesday (Jan 25-26) and over 100 of the S&P 500 Companies reporting earnings. We will be listening closely for indications of

We expect volatility to continue and markets to have heightened reactions to economic data and Fed commentary. We note again that most analysts’ estimates for corporate earnings in the coming year remain reasonable. This leaves room for upside “surprises” -- especially if supply chain and inflation issues are peaking as we suspect and begin to have less of an impact.

In summary

The turbulence of the past few weeks can be draining, and volatility is uncomfortable – particularly when new, market-moving information seems to arise daily. It remains important to assess the medium-term outlook rather than react to short-term fluctuations. The last few weeks have created greater uncertainty in that outlook, but there remains a viable path to stabilization in the coming weeks and months.

Stay on top of the latest news and insights from BMO Wealth Management