Looking for something else?

Welcome

No one enjoys end-of-life planning. But properly designed, completed and executed estate plans that include wills, powers of attorney and trusts are crucial to protecting your legacy and ensuring the seamless transfer of assets to your heirs.

Today, that includes providing family members with access to or control of your information, including your digital and online property. These assets range from your social media accounts and electronically stored photos and videos, to domain names and blogs, to blockchain assets such as cryptocurrency, non-fungible tokens (NFTs) and central bank digital currencies (CBDCs).

Just like you would for your house, your retirement savings and that special family heirloom, you can arrange to have your digital property managed, safely administered and smoothly passed to your beneficiaries. Estate plans can also designate a digital trustee to oversee your online accounts and direct executors on locating and securing your online account information and access credentials.

What do I need to know about protecting my digital property?

At the time of this writing, digital assets have surpassed a $2 trillion market cap with a staggering number of Americans investing in, trading or holding cryptocurrencies, which has inspired President Biden to sign an Executive Order1 identifying priorities for the regulation of this innovative space.

Most states have enacted laws to address access to someone’s digital assets after death or incapacitation and have adopted a version of the Revised Uniform Fiduciary Access to Digital Assets Act (RUFADAA). The 2015 RUFADAA gives executors and trustees access to digital assets, subject to some limitations. Still, legislation governing digital assets varies at the state level, and some cross[1]border differences exist.

Some digital platforms (such as Apple, Google and Microsoft) now allow users to set “Legacy Contacts” and to decide who can access your account assets—photos, notes, mail and more—after you pass away. Social media platforms such as Meta (formerly Facebook), Twitter, LinkedIn and Pinterest do something similar. Upon first creating their accounts, most consumers accept a platform’s long[1]winded terms of service agreements and privacy policies without even glancing at them. This leaves open the possibility you’ve signed away the rights to transfer your assets or to memorialize your online presence.

What can I do to protect my digital assets?

For executors, a challenge is often just determining whether digital assets are in the decedent’s estate, and then determining the powers and terms for accessing and administering them on the beneficiaries’ behalf. When it comes to blockchain technology, executors need to know the whereabouts and details of the private key(s). Some good first steps in planning for these assets are to:

Take inventory

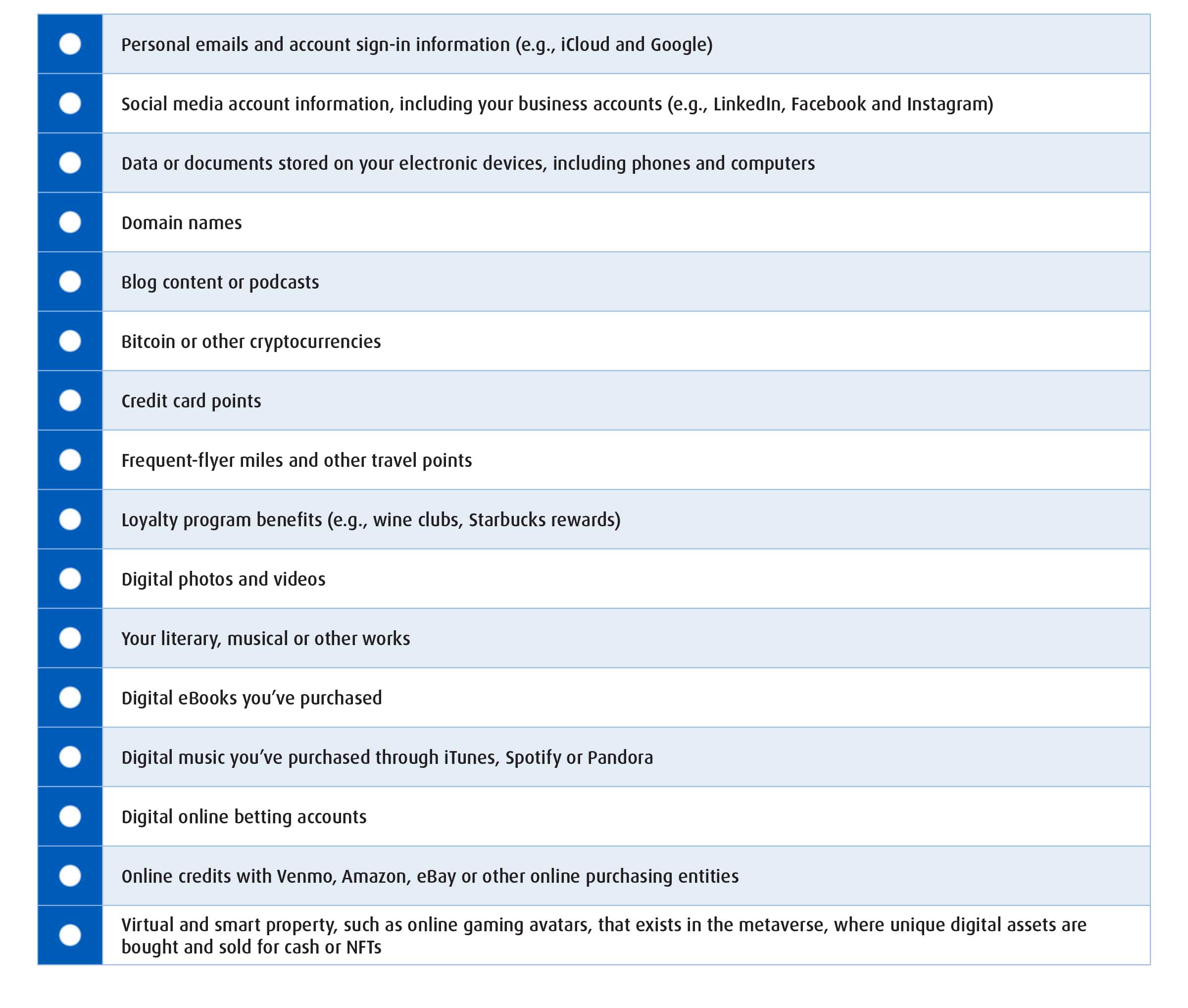

To understand your broad-based digital footprint, take inventory of your digital assets, including:

Get help from planning experts

Once you’ve inventoried your digital assets, have a proactive conversation with your BMO Private Wealth Advisor, who works closely with the firm’s trust and estate planning experts, who have substantial knowledge and experience in this area. We will help you develop this comprehensive digital asset inventory and, for each asset, harness the opportunities, understand the limitations and engage the best strategies for protecting them.

Planning “actions” must be performed while you are alive, from setting up cybersecurity protocols, antivirus subscriptions and access planning guides to legal authorizations, consents for release of electronically stored information, powers of administration/disposition and other legally binding documents.

Say you’re in the process of drafting a novel, and the file is saved in the cloud. That draft not only has emotional value but also potential financial value to your family should you pass away before completing it. The same holds true for family photos, an online diary or other tokenized assets, access to which you likely would want to control. Expert digital assets estate planners have several tax-efficient solutions and tools they can stress test, custom design and implement, where appropriate, to meet your intention and goals.

Conclusion

Without proper planning, digital assets could be lost. The more prepared you are, the stronger your estate plan will be, enabling you to avoid the pitfalls we see time and again. The key to success is early discussions with your BMO Private Wealth Advisor. Together, with your independent tax and legal advisors, our wealth planning team can help determine the appropriate estate planning strategies for you.

Stay on top of the latest news and insights from BMO Wealth Management