Looking for something else?

Welcome

The Consumer Price Index (CPI) for May showed an 8.6% annual increase and a 1% increase over April. The “Core” CPI measure that strips out food and energy inflation was up “only” 6% on an annual basis and 0.6% monthly. Those numbers called into question the market’s widely held belief that inflation had peaked. Indeed, it was difficult to find encouraging details even when parsing through the inflation report. The increases were quite broad-based, the largest being energy prices which showed no signs of abating and tend to ripple through the economy.

Implications for the Fed

Futures markets that are based on Federal Reserve target interest rates rose to indicated year-end expectations of about 3.25%. Prior to the CPI data release, those expectations were about a half percent lower (50 basis points). That is quite a dramatic shift, and clearly the Fed will look to raise rates by at least a half percent at the upcoming June, July, and September meetings. Even a three-quarter percent increase could be on the table for one of these meetings. Inflation may still have peaked, and data in the coming months could soften those year-end expectations. It seems likely, however, that the path to lower inflation will be bumpy.

Soft or Hard Landing?

The looming question is whether the Fed is still capable of engineering a “soft landing” – i.e., slow the economy enough to cool inflation without causing a deeper recession. On the positive side, historic tightness in the labor market implies that it can soften quite a bit and still only come back into balance. Additionally, the lack of high leverage or imbalances in the system – at either the consumer or corporate level – provides some comfort that a slowdown won’t necessarily feed on itself with downside momentum. Nonetheless, the economy’s recalibration to higher interest rates has practical limits before too much slowing sets in. It remains important that inflation numbers cool in the coming months so that the Fed’s hand isn’t forced much beyond the 3% short-term interest rates that the market currently expects.

Implications for Equity Markets

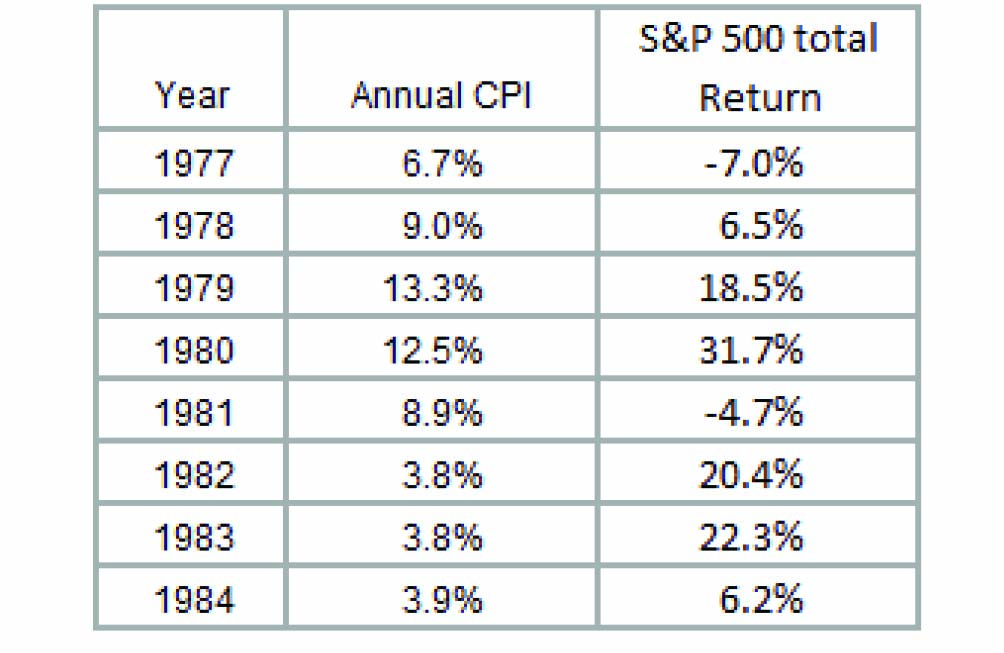

As the chart below shows, equity markets can hold their own even during times of high inflation. The current equity market downturn, however, began with high valuation multiples and high expectations for growth. Growth has slowed, interest rates have risen, and inflation has proven more persistent than the market’s expected – it’s been a difficult mix, both for equities and fixed income. It’s important to keep in mind that it is not one single factor that is responsible for the current market challenges. Additionally, China’s lockdowns have added to the slowdown in global growth and the war in Ukraine has further exacerbated inflation pressures here at home. At present, the market would like to get a sense that the interest rate increases and inflation pressures have a visible end in sight. It’s clearly a moving target, but the recent CPI data pushed that visibility back by at least a month, and probably more.

Exhibit#1: Consumer Price Index (CPI) and Stock Returns

Source: BLS, pages.stern.nyu.edu/~adamodar

Stay on top of the latest news and insights from BMO Wealth Management