Looking for something else?

Welcome

Whether you are a new parent looking to provide for your child’s college education or you are thinking about going back to school yourself, with some advance planning, you can start taking advantage of the benefits available to you.

There are many ways to save for education—whether for K–12 and preparatory school or college and graduate programs—and each offers its own set of benefits. College savings plans provide tax savings opportunities while other savings plans allow for higher contribution amounts and flexibility in using the funds. Some savings vehicles can also be used in conjunction with tax credits if you meet the requirements.

Only 529 college savings plans and Coverdell Education Savings Accounts (ESAs) have tax advantages, but the flexibility of UTMA/UGMA accounts or gift trusts may make them better suited to your needs.

Section 529 college savings plans offer tax benefits but must be used for education costs.

Arguably the most popular college savings plans, 529 plans provide tax-deferred growth and tax-free distributions if the withdrawals are used for qualified higher or post-secondary education expenses. Qualified expenses include tuition, room and board (if the student attends at least half time), supplies, special needs services, equipment and even internet access. Distributions that are not used for qualified expenses are subject to income taxes and penalties.

As the owner of a 529 plan, you retain control of the assets at all times, and you can change the beneficiary to another child if you choose. Some states even allow you to deduct a certain amount of 529 plan contributions from your taxable state income. Your investment choices are generally limited to those offered in the plan, and in most cases, you are only able to change your investments up to two times in a calendar year.

In 2017, the Tax Cuts & Jobs Act expanded qualified expenses to include tuition for K-12 schools of up to $10,000 per beneficiary per year. However, it is important to note that this is Federal legislation and not all states have adopted this change. You will need to consult with your tax advisor on whether your state follows this Federal provision.

Contributions to a 529 plan are considered a gift to the child. Therefore, in order to avoid gift tax consequences, you can limit your contributions, plus any other gifts, to a particular child to $16,000 per year (as of 2022). Spouses together can give $32,000 (as of 2022). You can also front-load up to five years of annual exclusion gifts by making a one-time $80,000 contribution (5 x $16,000), or $160,000 contribution (5 x $32,000) for married couples. If you do, you will need to file a gift tax return for the year and you cannot make additional contributions or gifts to the child for an additional four years without incurring a gift tax. Grandparents sometimes make this type of gift in order to reduce their taxable estate.

When contributing to a 529, keep in mind that each state will have their own maximum allowed account values, which can be as low as $235,000 (as for Georgia) or as high as $550,000 (as for Missouri). Once an account value reaches a certain point, contributions to that account are no longer allowed.

Section 529 plans may also be structured as prepaid tuition plans, allowing you to lock in current tuition costs. However, be mindful that these types of plans may include restrictions or reduced benefits if you don’t use the assets in a specified state or within a certain period of time.

Coverdell Education Savings Accounts (ESAs) can be used for K–12 expenses and college but have low contribution limits.

With broad investment selections and no trading limitations, Coverdell ESAs may be a good way to save for education costs from Kindergarten through college. Qualified expenses are the same as for 529 plans but also include Kindergarten through 12th grade expenses as well as payments into a qualified tuition plan (like a 529 plan). One caveat: contributions are capped at $2,000 per beneficiary per year and phase out once your modified adjusted gross income (MAGI) for 2022 exceeds $95,000-$110,000 (or $190,000-$220,000 for joint filers). In addition, all of the funds in an ESA must be distributed by the time the beneficiary reaches age 30, unless the beneficiary is one with special needs.

Savings bond redemptions used for education are tax-free if you meet the requirements.

The proceeds you receive when you redeem Series EE and Series I U.S. Savings Bonds may be free from income tax if you use them for qualified education costs (excluding room and board) for yourself, your spouse or a dependent. There are stipulations:

Importantly, to qualify for tax-free treatment, you can use the savings bonds proceeds to pay for qualified education costs directly or to make a contribution to a Coverdell ESA or 529 plan.

UTMA/UGMA accounts offer greater flexibility.

If you want to give a child or other minor the option to use the money for any reason—not just education—consider a Uniform Transfers to Minors Act (UTMA)/Uniform Gifts to Minors Act (UGMA) account. These accounts offer:

However, you relinquish control of the assets in an UTMA/UGMA account once the child comes of age. Furthermore, earnings from UTMA/UGMA accounts may be subject to kiddie tax rules, which could make the income taxable to the parent. Plus, the assets can only be used for the child named on the account and can’t be transferred to another child.

Gift trusts and paying for school outright

For wealthy individuals and families, another consideration to keep in mind is that payments of tuition by a family member (or anyone really) made directly to the school are not subject to gift tax reporting or limitations. For families with taxable estates, often paying the tuition directly is the optimal strategy to further reduce their taxable estate vs. the benefits from funding a 529 account.

By paying for school directly, wealthy families could instead utilize their annual exclusion gift amount of $16,000 ($32,000 for a married couple) to fund a gift trust for the benefit of the child (“Trust”).

With a Trust, instead of just giving a child the funds outright, parents are able to exercise control over how the child can benefit from the Trust assets as spelled out in the governing Trust agreement (e.g., the beneficiary may have access to certain amounts after meeting certain milestones or reaching a specific age, etc.).

Establishing a Trust does create another level of complexity. Not only will you need to hire an attorney to create the Trust, but annual accounting is required, which may include the filing of trust income tax returns.

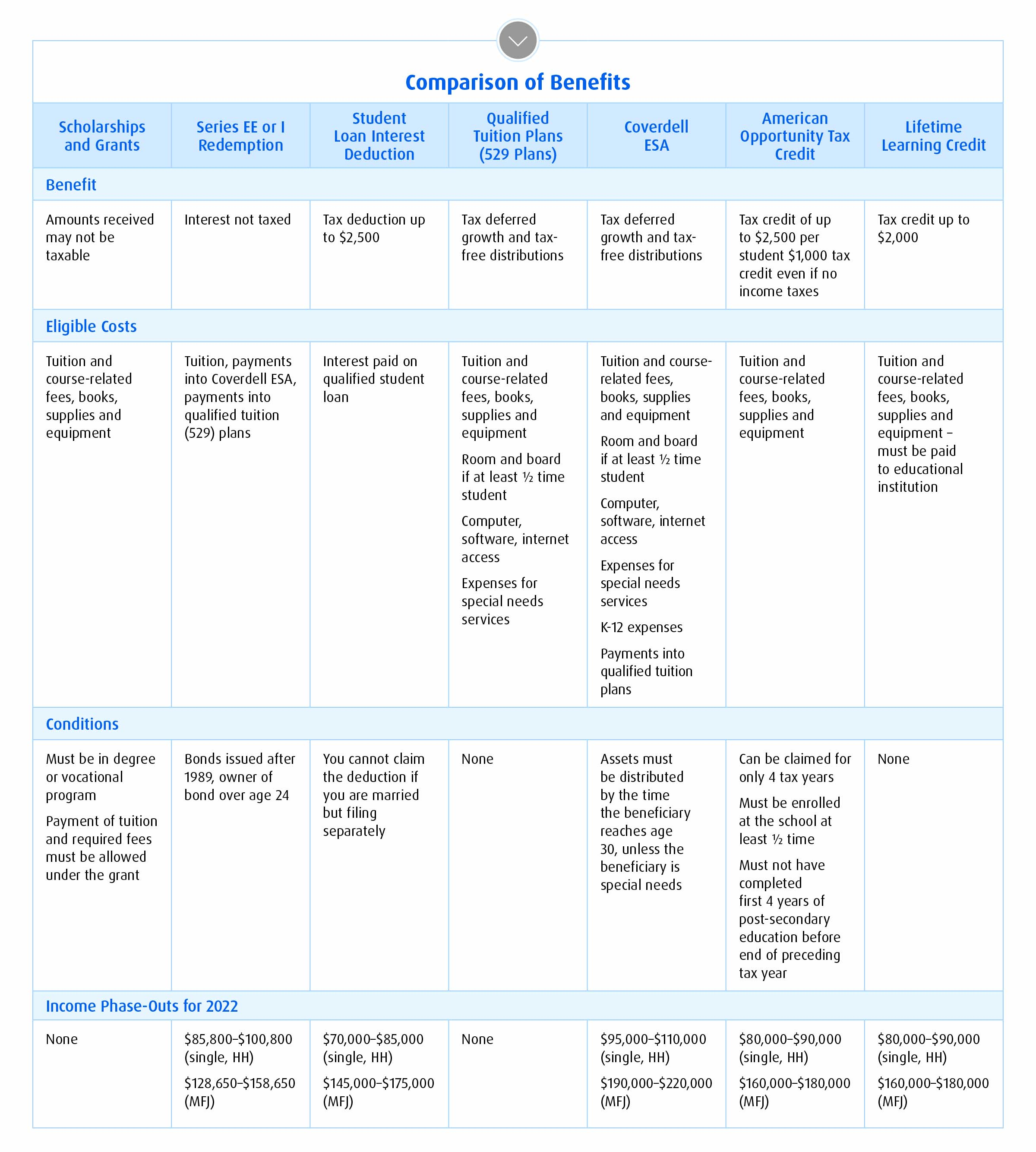

Once you choose your savings vehicle, it’s time to explore whether you can take advantage of other ways to minimize taxes. Some are discussed below and compared in the accompanying chart.

Tax-free scholarships or grants can help cover tuition costs.

From academic and athletic scholarships to qualifying grants, these awards are typically tax-free to the recipient provided they are used for qualified education expenses, including tuition, books and related fees. They generally exclude room and board. There are usually no income limits to receive a tax-free scholarship, although certain grants may be needs-based.

Tax credits can also help you offset education costs.

While tax deductions reduce the amount of your taxable income, tax credits come directly off of the amount of income tax you owe.

It is important to note that you cannot claim both credits listed above within the same calendar year for the same student, but you could claim one of each for two different students. Further, while tax credits and distributions from 529 plans can be claimed in the same year, the IRS does not allow for the same expense to be covered by both benefits (i.e., no double-dipping).

Tax deductions

While the tuition and fees tax deduction was repealed with the Taxpayer Certainty and Disaster Tax Relief Act of 2020, the Student Loan Interest Deduction is still available to those who qualify.

Student loan interest deduction allows you to deduct the lesser of $2,500 or the amount you paid in interest on a qualified student loan for the tax year. This deduction is claimed as an above-line adjustment to income (you do not need to itemize) but is phased out when your (2022) MAGI is between $70,000 and $85,000 (single or head of household). You cannot claim the deduction if you are married but filing separately. For those married filing jointly, for 2022 the phase out is between $145,000 and $175,000.

CARES Act update: In March 2020, The Coronavirus Aid, Relief, and Economic Security Act (the CARES Act) was enacted which included relief for borrowers with student loans specifically owned by the Department of Education. By executive order, President Biden has extended the relief provisions on student loan deferment through August 31, 2022. These relief provisions include:

A common question asked by clients is what are their options if they don’t end up using all their funds saved in a 529? Options include in this scenario:

Change the Beneficiary. You can change the beneficiary on your 529 plan to any qualified family member of the beneficiary’s family (spouse, siblings, step-siblings, nieces, nephews or their spouses, in-laws, first cousins, etc.).

Additionally, there are no time limits on a 529, so you could even keep the funds invested to provide for the future education of grandchildren. One caveat to be considerate of is that gift and generation-skipping transfer taxes could become an issue depending on the age of the new beneficiary and the size of the account being changed to them.

Help pay down student loans. Under the Setting Every Community Up for Retirement Enhancement Act (the SECURE Act) signed at the end of 2019, you are allowed to make tax- and penalty-free withdrawal of up to an aggregate lifetime limit of $10,000 to be used towards paying down qualified student loans for the beneficiary as well. Additionally, another $10,000 can be withdrawn per each of the beneficiary’s siblings to cover qualified student loan payments.

It should be noted the student loan interest deduction mentioned above cannot be used in conjunction with the amount paid for from the 529 distribution.

Pay the taxes. Should you decide you do not need the 529 account anymore and want to use the funds elsewhere, you could withdraw the balance in a non-qualified distribution. Your after-tax contributions made to the 529 are not subject to taxes, but you will be subject to income tax and a 10% penalty on the earnings portion of the withdrawal (plus state penalties, if any). Additionally, you may also be subject to the recapture of state income taxes if you benefited from prior state income tax deductions.

Note on scholarships: if your child benefited from a scholarship, you could make a non-qualified distribution from your 529 up to the amount of the tax-free scholarship and not have to pay the 10% penalty, although you will still pay income taxes on the earnings portion of the withdrawal. As discussed above, the tax-free portion of scholarship typically covers tuition, books and student fees. Portions of the scholarship that cover living expenses like room and board are generally considered taxable.

Stay on top of the latest news and insights from BMO Wealth Management