Looking for something else?

Welcome

2023 in Review

The past year repeatedly took markets to the edge – gripped by fears of recession, banking sector turmoil, rising interest rates, and multiple wars. Mega-cap technology, turbo-charged by the generative AI revolution, dominated equity market gains. Despite the winding path, our House View for 2023 was steadfast in expecting an economic soft landing underpinned by a stable labor market and falling inflation. It was a year for economic “recalibration” to higher interest rates1, which led us to favor a balanced approach to portfolio risk that has broadly proven appropriate.

2024 Macro Outlook

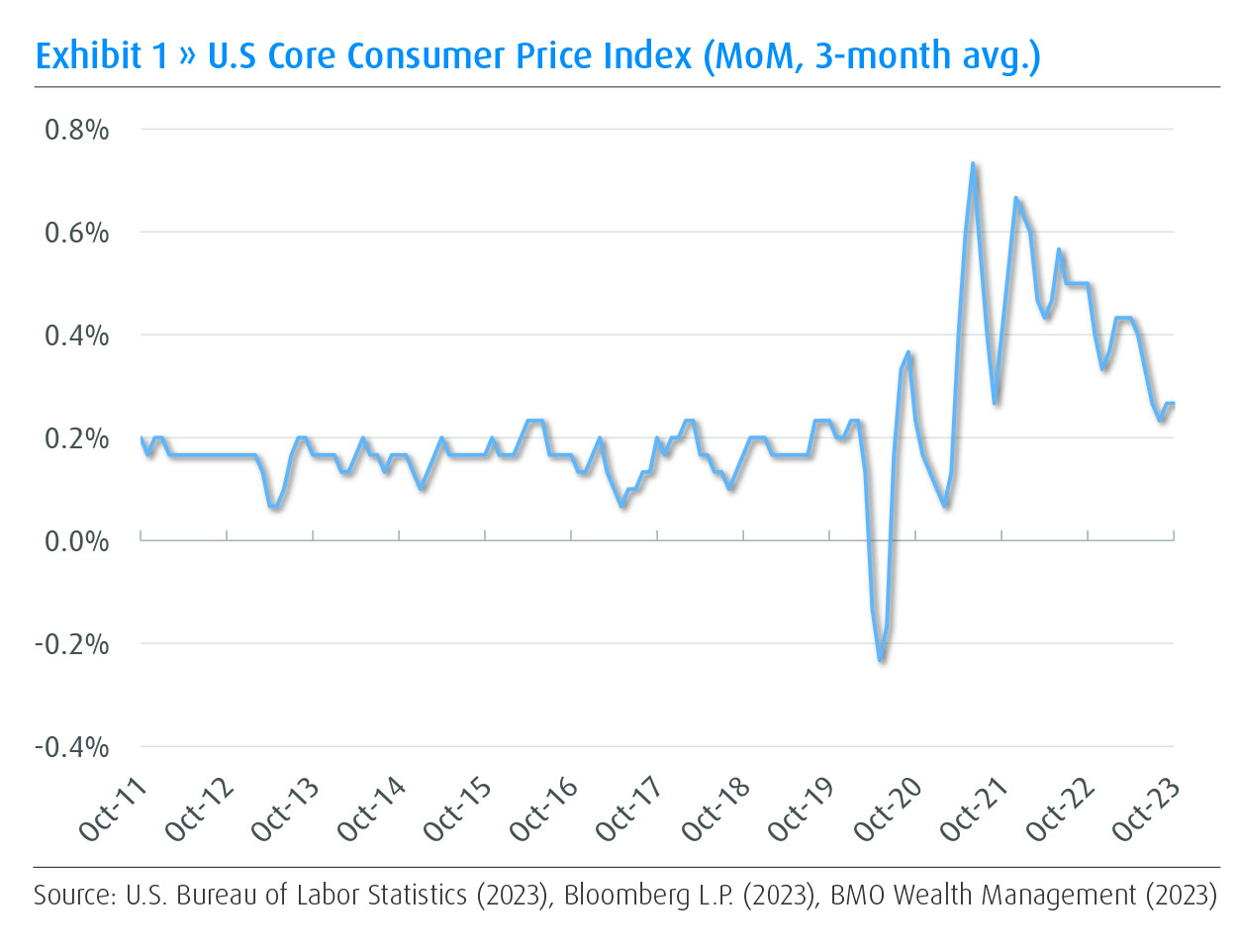

Recent economic developments include falling inflation (Exhibit 1) combined with signs of consumer stress and corporate pullback, such as rising credit card and auto loan delinquencies and moderating business capital spending. As job growth slows, certain labor market indicators are moving back into balance, but the cutting edge of Weekly Initial Unemployment Claims points to continued health. The question is whether the incipient slowdown will gather momentum and morph into a hard landing/recession or whether there exists sufficient economic resilience to stabilize and turn growth higher as the year progresses.

Base Case Scenario: Slowdown, Stabilize, Shift (60% likelihood)

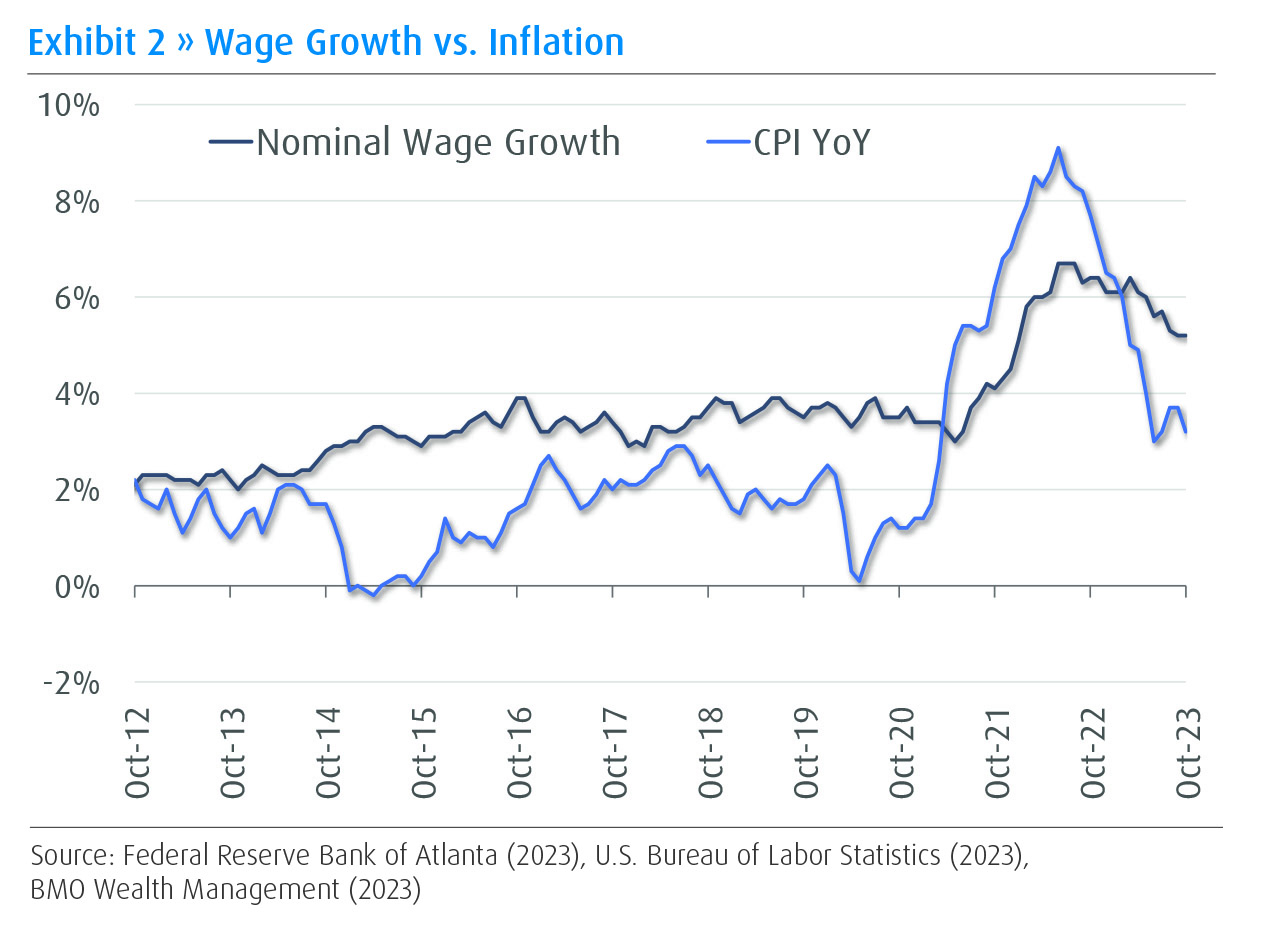

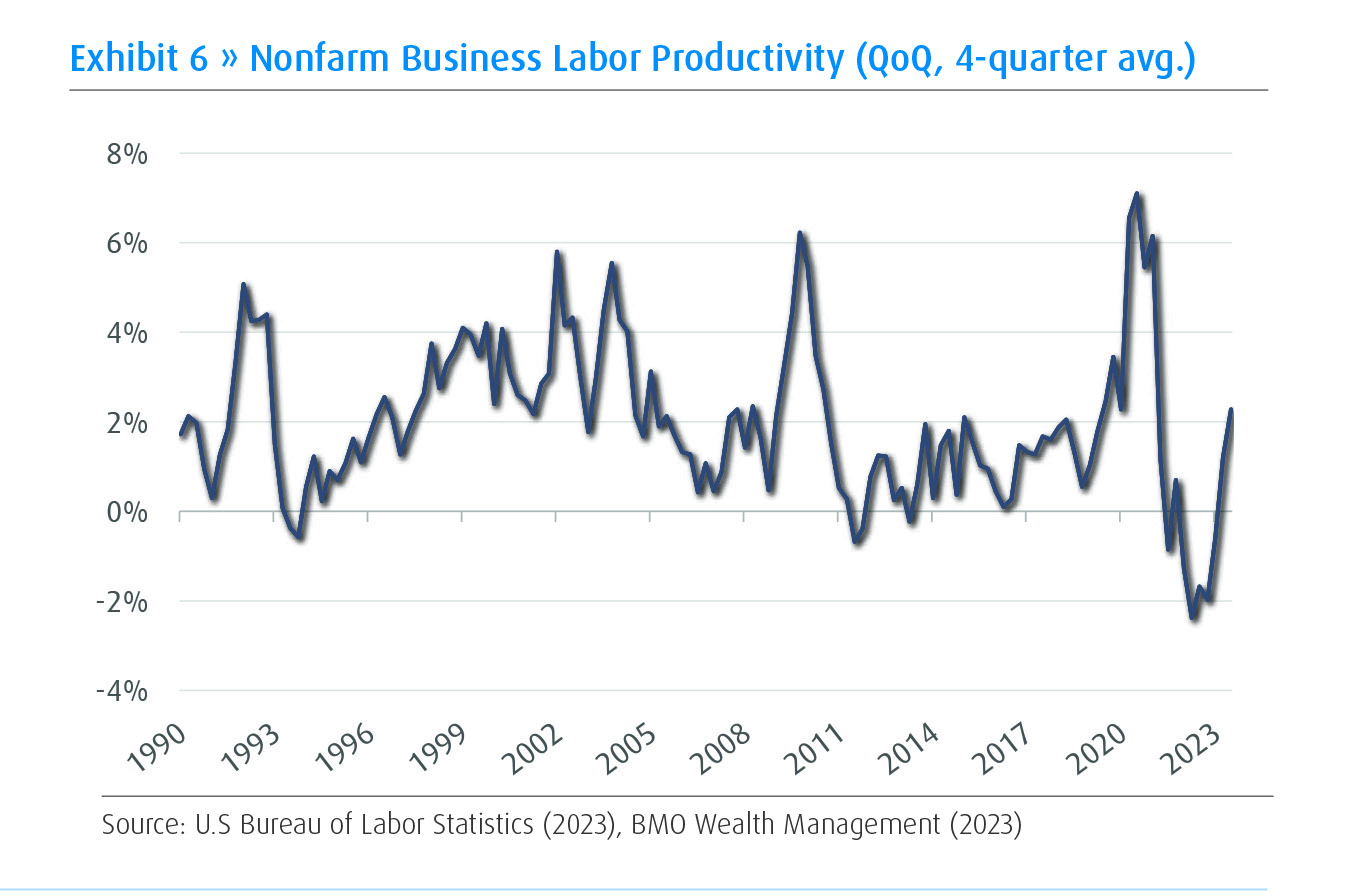

An economic soft landing remains our base case scenario. The path to a soft landing begins with continued falling inflation, which steers the Fed toward cutting short-term interest rates later in the year. Although our expectation for two or three Fed rate cuts in 2024 is less optimistic than the market’s current assessment, the directionality matters more than pace as long as a soft-landing prevails. In this scenario, the labor market, consumer spending, and corporate spending all “bend but don’t break” amid the economic slowdown in the early months of 2024. Gradually, wage growth that exceeds inflation (Exhibit 2), modest productivity growth, stable corporate profits, lower interest rates, and a corporate sector that becomes increasingly comfortable with a healthier spending environment first stabilizes and then shifts growth and profits higher in the economy.

Upside Scenario: A Sharper Upturn (20% likelihood)

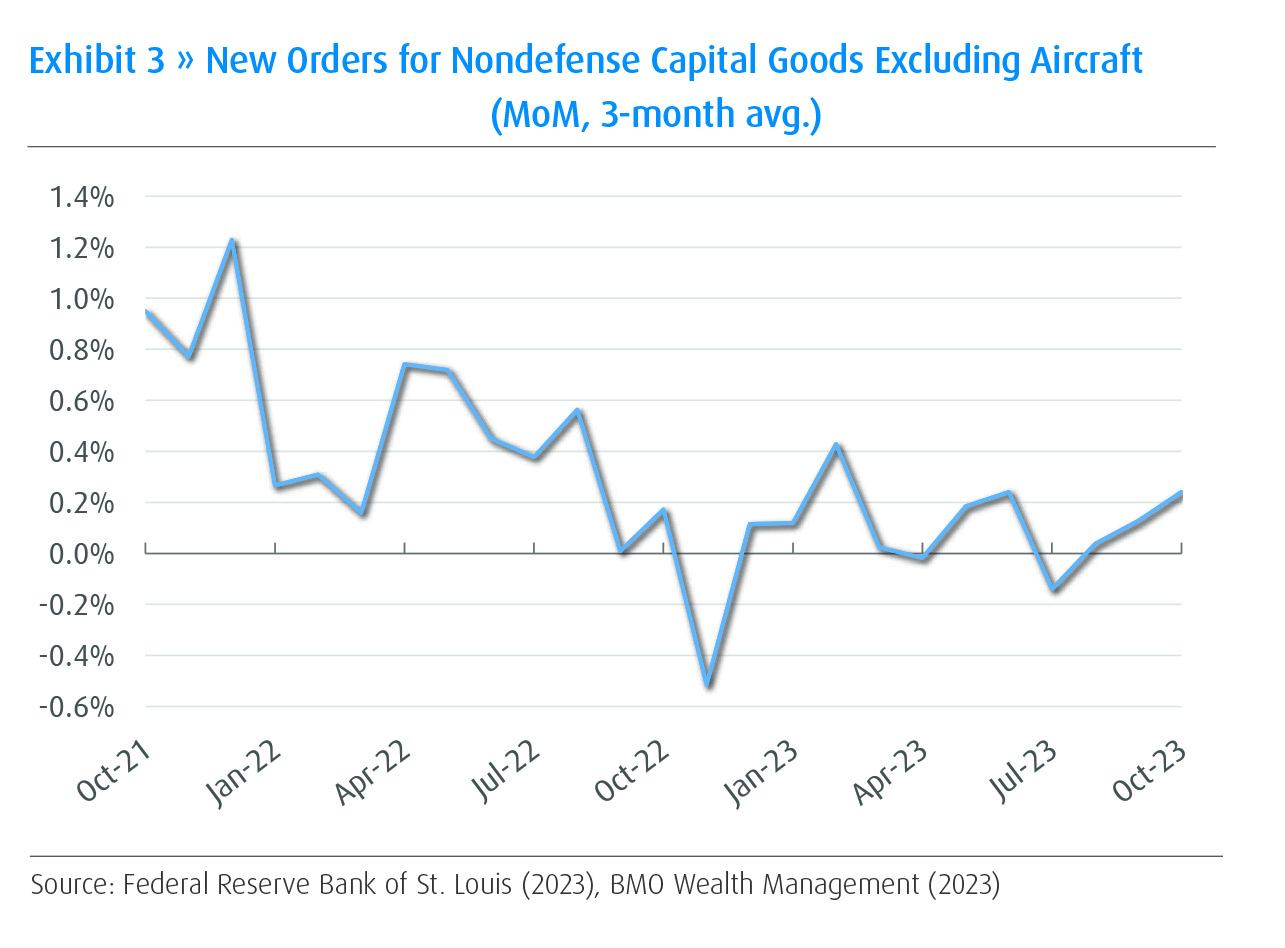

The key distinction in an upside scenario is that the slowdown is brief and mild, and the upturn is vigorous and arrives quickly. The same macro elements exist as in the Base Case Scenario, but consumer and corporate spending are more resilient than anticipated and/or productivity growth kicks in more strongly. Early indicators that the Upside Scenario is taking shape would include consumer spending on big ticket items reaccelerating and capital expenditures by corporations spiking upward (Exhibit 3).

Downside Scenario: Falling like Dominoes (20% likelihood)

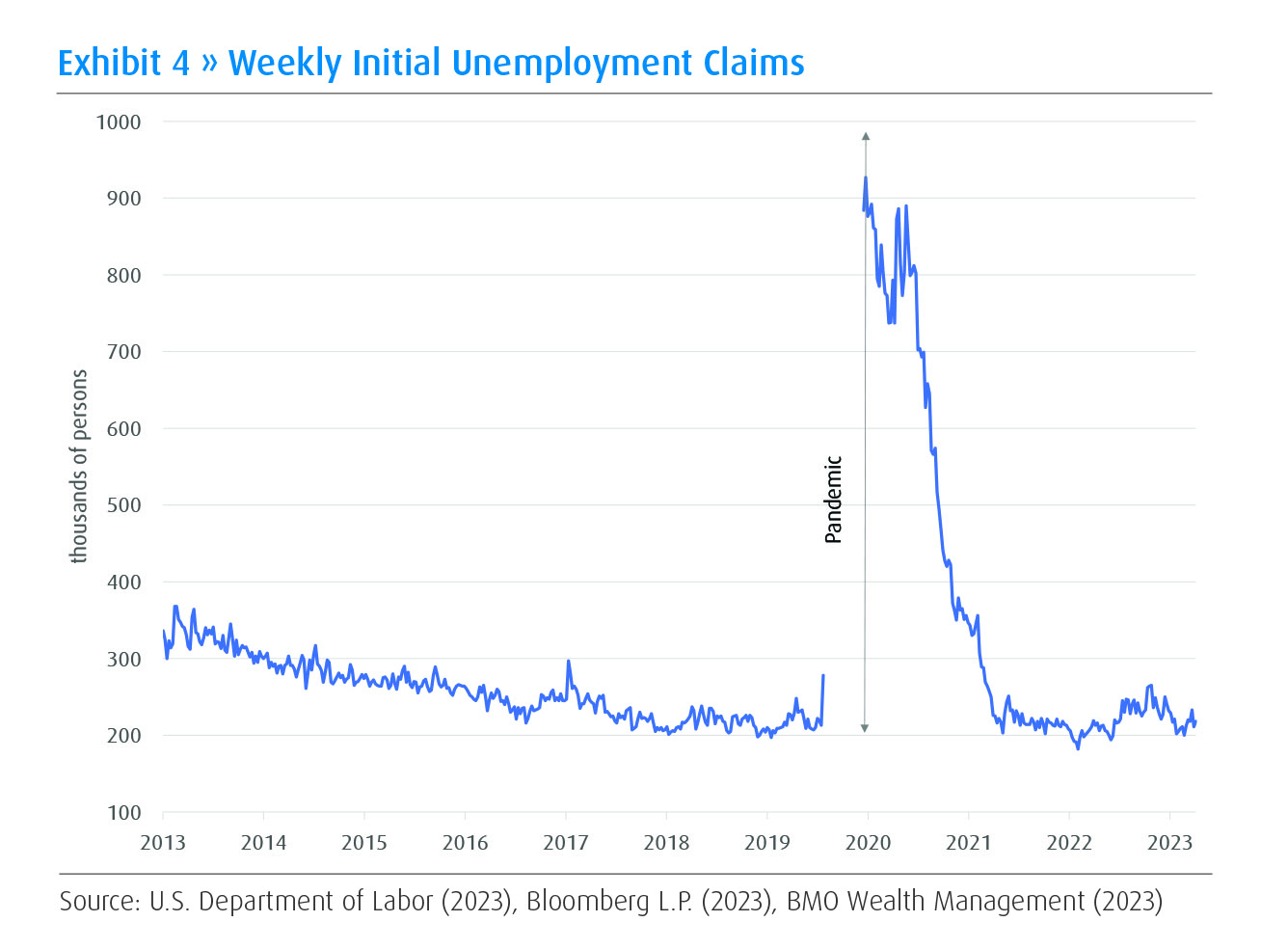

In this scenario, consumer spending weakness and corporate belt-tightening feed on each other as high interest rates weigh more heavily on economic activity. The slowdown accelerates layoffs, further depressing consumer spending. It is even possible that inflation makes a comeback later in the year, dashing expectations for Fed rate cuts and pushing long-term interest rates higher. An early indicator that the Downside Scenario is taking shape would include multiple upward spikes in Weekly Initial Unemployment Claims, which has so far been a picture of stability (Exhibit 4).

The Fed, Interest Rates, and Fixed Income

Focusing on our Base Case Scenario, we believe the Fed will soften its tone in early 2024 and embark on a rate cutting path later in the year. Short-term rates are likely to finish 2024 in the mid-to-upper 4% range, while longer-term rates stabilize or drift modestly higher from current levels resulting in a relatively flat yield curve. High-quality fixed income should offer both an appealing, mid-single-digit return and the benefit of portfolio protection in case downside momentum or a negative shock rattles the economy. Bonds are back, indeed. Should a negative economic scenario unfold, the likely continued fall in inflation would allow the Fed to cut rates more aggressively and eventually restore economic growth. In short, we are starting 2024 amid headwinds, but like a reed have high flexibility.

Equity Markets

In the early months of 2024, it is unclear whether the projected fall in inflation and softer Fed messaging will be enough to bolster equities in the face of a likely economic slowdown. As 2024 progresses, however, we believe that equity markets will respond positively to the approaching Fed rate cuts and the economic stabilization and upturn that we expect by the spring or summer months.

In contrast to 2023, we expect equity gains in 2024 to be relatively broad-based and also include the “Value” segment of equities rather than concentrated in a handful of mega-cap growth companies. Equity returns in line with historical averages – high single digit or low double digit – are reasonable for the year given the expected acceleration of earnings growth and Fed rate cuts later in the year.

Internationally, we believe Japan should continue to benefit from recent structural changes that include shareholder-friendly policies and actions by the government, stock exchange, boards of directions, and investors. Emerging markets stand to benefit from falling interest rates and an improved outlook for global growth as the year progresses.

2024 Elections

The latter part of 2024 will likely see reduced economic uncertainty as fewer variables bump against extremes. Political uncertainty, however, is sure to continue throughout the year and only move toward resolution following the November elections. Specific outcomes and probabilities are difficult to assess at this time, but the concern of seemingly unpredictable elections is largely offset by our expectation that most outcomes will result in consistent fiscal spending post-election. As 2024 unfolds, stay tuned in for our in-depth commentary on election implications.

Positioning and Risk

We enter 2024 with similar guidance as we began 2023 – the outlook calls for a balanced approach to risk and we expect the year to produce gains to both equities and fixed income that are in line with historical averages. The consistency of this message fits with the consistency of our outlook between last year and today – specifically, that an economic soft landing is the most likely scenario and that the recalibration to a higher interest rate environment will take time but is manageable for the markets. The soft landing has come a long way in 2023 but is not yet complete.

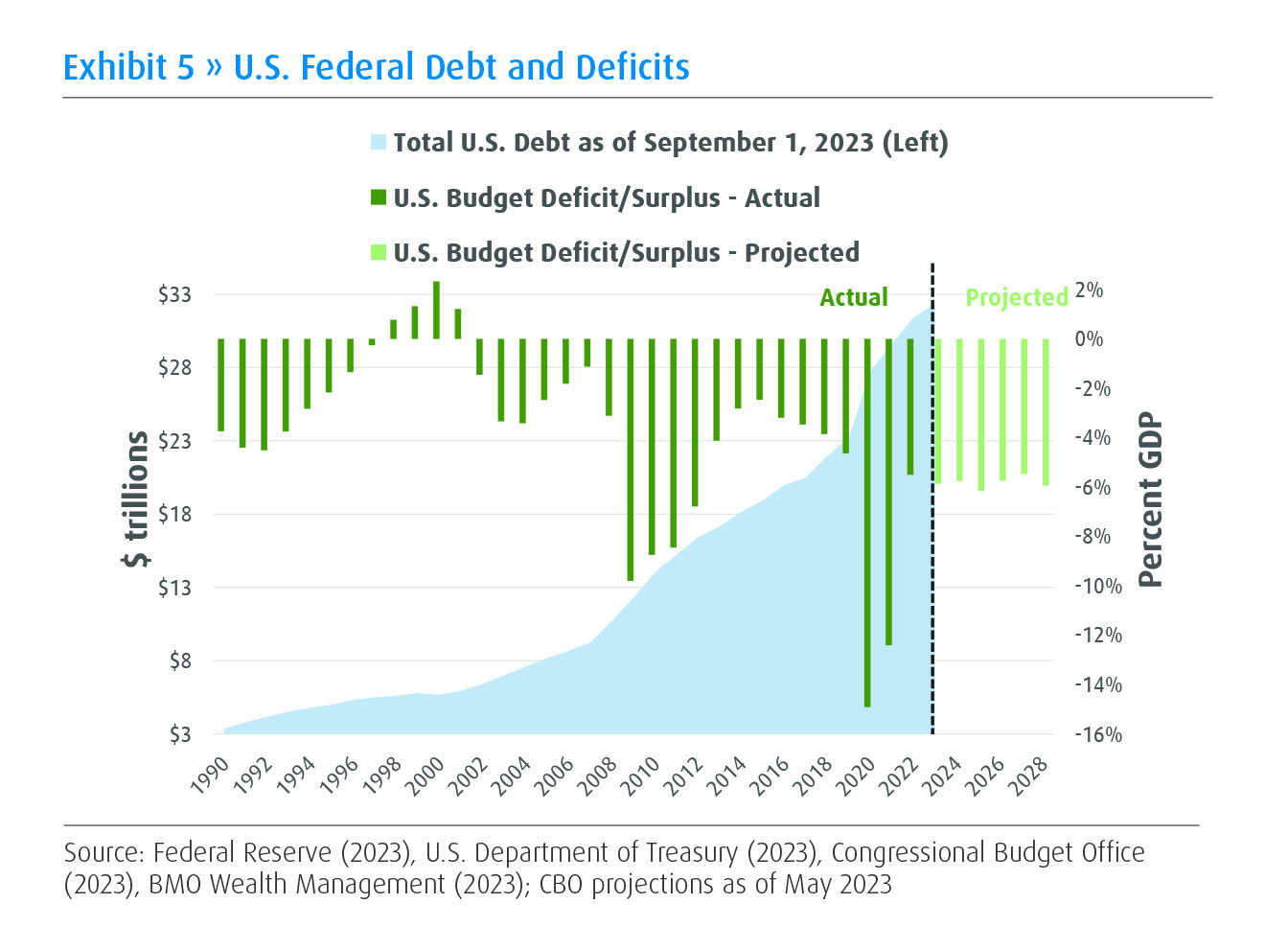

Our “Downside Scenario” probability of 20% in 2024 represents modestly above-average risk, with the main near-term risk being greater than anticipated corporate pullback and the main late-year risk being a resurgence of inflation. There is, as always, the risk of an unanticipated “shock” – certainly COVID fit that description in 2020, but a difference now is that our fiscal ammunition has been largely spent and the economy is now more susceptible to such unexpected events (Exhibit 5).

We continue to emphasize high-conviction positions such as US infrastructure, Japanese equities, and reinsurance/catastrophe bonds. We also believe that the equity market gains in 2024 will be relatively broad-based across the size and value/growth spectrums. The most notable upside risk for the economy and equity markets is that the proliferation of artificial intelligence has potential to drive productivity gains sharply higher in 2024 and beyond (Exhibit 6). Resilience, adaptability, and innovation have been hallmarks of the economy in 2023, and we see those factors carrying us through in 2024 as well.

_________________________

1 See BMO Wealth Management 2023 Outlook, The Great Recalibration

Stay on top of the latest news and insights from BMO Wealth Management