Looking for something else?

Welcome

Whether the goal is to improve a local community or support a more far-reaching cause, charitable giving is an important goal for many investors. With donations of cash or other assets, you can support a nonprofit organization’s mission, while also teaching future generations about empathy and generosity. According to the National Philanthropic Trust (NPT), in 2020, individuals donated $326.87 billion, about 67% of overall giving1.There are a variety of ways to support the causes you believe in, including the following:

Donate directly

Designate a charity as the beneficiary of your Individual Retirement Account (IRA) or 401(k)

Charities do not pay income tax on donations they receive from these accounts. However, you may need spousal consent in the case of a 401(k); check your state’s laws.

Establish a donor-advised fund (DAF) or your own private foundation (PF)

Both a DAF and PF offer an immediate income tax deduction in the year of the gift and allow you to distribute the funds over an extended period of time.

The growing popularity of donor-advised funds

NPT’s 2021 DAF Report states that, as of 2020 (the latest available data), assets held in DAFs amounted to an estimated $159.83 billion, up 9.9% from 2019, due to increased contributions and investment gains. Contributions to DAFs totaled $47.85 billion in 2020, reaching an all-time high. Moreover, the estimated total number of DAF accounts stood at 1,005,099 in 2020, compared with approximately 90,000 private foundations2.

As further noted in NPT’s 2021 DAF Report, while there are more than eleven times more DAFs than PFs, private foundations hold about 7 times the amount of assets than DAFs. Private foundations generally have larger balances (such as the Bill and Melinda Gates Foundation) and have been in existence much longer, giving them the benefit of compounded growth over the years (consider the Rockefeller Foundation). The first DAFs were created in the mid-1930s and only became popular with the growth of national DAF programs starting in the early 1990s.

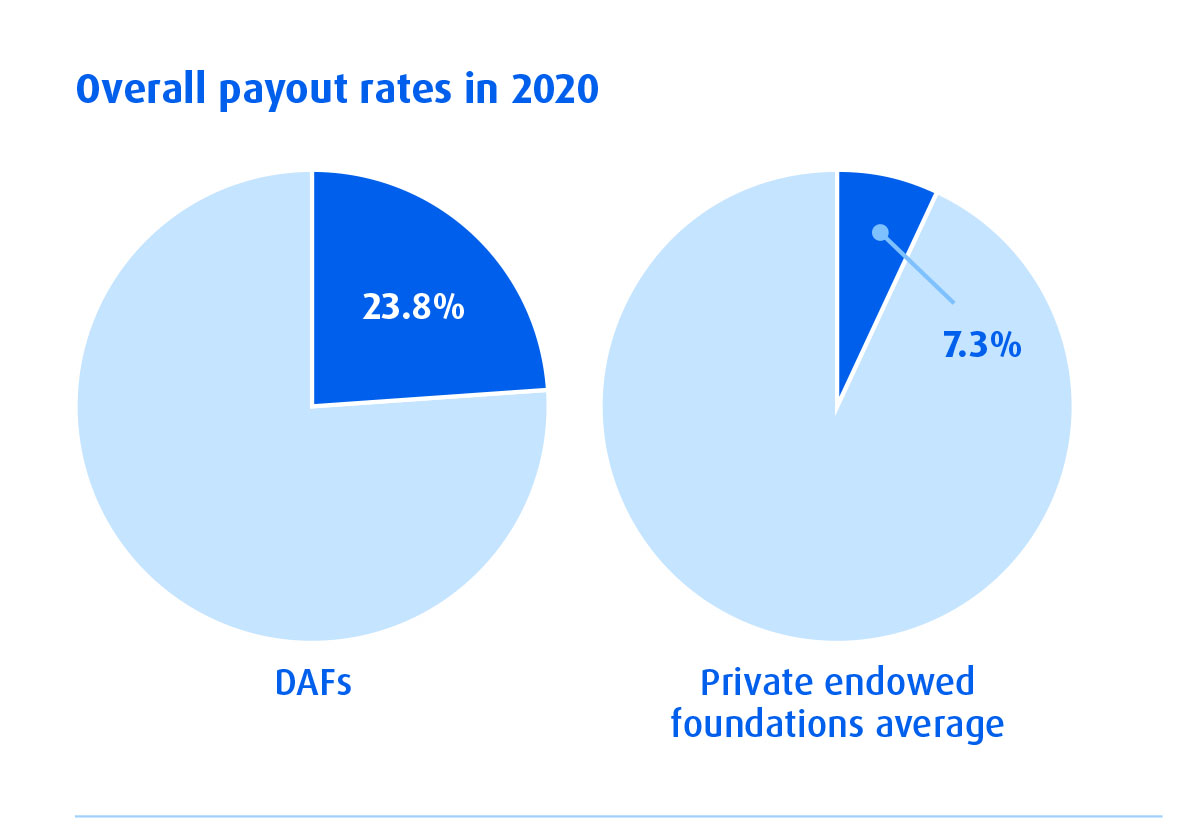

Despite having lower overall assets, DAFs have historically had much higher grant payout rates (grant payments divided by total assets, multiplied by 100) than private foundations. DAFs are not subject to the 5% minimum required distribution requirement that private foundations (“PF”) are. Nevertheless, the overall grant payout rate for DAFs in 2020 was 23.8% and has remained above 20% each year since the NPT started collecting the data in 2007. In contrast, the average payout of private, endowed foundations was 7.3% in 2020.

Today, charitable sponsors of DAFs exist in every state. The charitable sponsors fall into three categories:

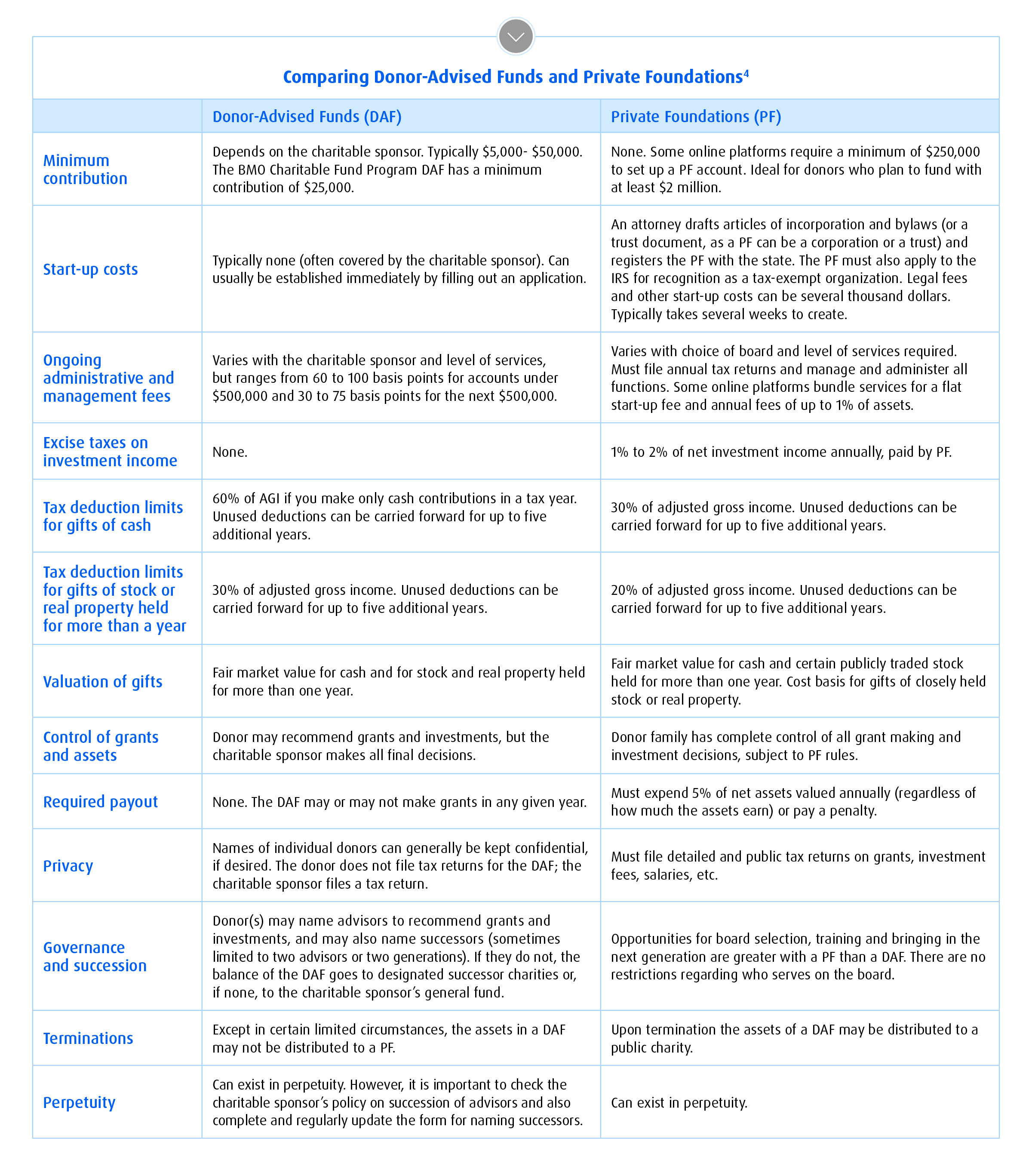

Choosing between a DAF and a PF

Below are some high-level guidelines to help you compare a DAF and a PF. Note that our discussion of PFs is limited to grant-making foundations operated by individuals and families, and excludes private operating foundations and corporate foundations,.Your financial professional can help you determine if a DAF or PF is right for you.

A DAF may make sense if you are:

Although a DAF offers lower administrative and management fees, more favorable potential income tax deductions, and no excise tax on investment income, a PF provides greater control in the areas of grant making and investing. This is because a donor to a DAF must surrender discretion and control over contributed assets, retaining solely advisory privileges. The sponsoring charity makes all final decisions with respect to DAF grants and investments.

A charitable sponsor of a DAF typically offers several investment pools into which you can allocate funds for investment (although most charitable sponsors will permit independent and active management of a DAF account if it has a minimum balance determined by the charity — typically $250,000 to $1 million). On the other hand, you may retain complete control of the investment of funds in your PF within the PF rules; PF investments are not limited to a selection of investment pools.

In addition, as a donor to a PF, you can exercise full control over grant making. With a DAF, the charitable sponsor has the legal right to approve or deny a grant and makes all the final decisions. However, it’s important to note that you can make recommendations and, in practical application, the charitable sponsor usually approves recommendations for grants to 501(c)(3) public charities.

Finally, as a donor to a PF, you may appoint its board members, including family members, providing the opportunity for your family’s future generations to participate in its legacy through philanthropy. A PF may operate in perpetuity, and successive generations may serve on the board. A PF exists until its board votes to dissolve and unwind its operations.

See the accompanying table for a more detailed comparison of the two vehicles.

Whether the goal is to improve a local community or support a more far-reaching cause, charitable giving is an important goal for many investors.

Going Deeper: From Charity to Philanthropy

There’s been a growing interest in philanthropic contributions of late, and it’s not hard to see why. Challenges in our communities and around the world are ever-increasing while income inequality is on the rise. Many affected by the realities on the ground are looking to make an impact with their wealth. Tired of traditional giving, they’re drawn to new, innovative ways of giving back. Besides, it’s tremendously rewarding.

So, what exactly is philanthropy and how does it compare to other giving initiatives like charity? To be sure, both charity and philanthropy use time and/or money to help people or a cause. Not surprisingly, many engage in charitable giving while also pursuing a more strategic philanthropic involvement. But there are distinctions worth noting.

Charity is typically an emotional response, a desire to help. Whether giving once or year-over-year, the intent is to bring (oft-time urgent) relief to a situation that requires it. You may give money to the Red Cross, for example, to support victims of the war in Ukraine. Or donate meals to a food bank during Christmas. Charity comes from the heart and can do a lot of good.

Philanthropy goes beyond that, and dives into the root causes of society’s intractable challenges and tries to find solutions. It involves targeted interventions that reflect the values and aspirations of the person giving and are an expression what you as the donor feels is important.

According to the latest report from Wealth-X, in 2020, philanthropic giving around the world totaled approximately $750 billion5.

What makes the rise of philanthropic giving all the more interesting is that its donors comprise an ever-expanding ecosystem made up of corporations, public and private foundations and a growing number of wealthy individuals intent on using their money to make a difference.

To be sure, philanthropy has become a powerful part of BMO Wealth Management's focus. It goes well beyond discussing a financial plan. It’s about asking what wealth means to you, and how you’d like to use it today or in the future.

Feel confident about your future

BMO Wealth Management — its professionals, its disciplined approach, its comprehensive and innovative advisory platform — can provide financial peace of mind.

For greater confidence in your future, call your BMO Wealth Management Advisor today.

Stay on top of the latest news and insights from BMO Wealth Management