Looking for something else?

Welcome

It’s been a rocky start to the year, so let’s begin with the good news. The jobs report released in early February showed a healthy increase of 467k jobs created in the prior month, largely dispelling fears that soft data points in January would lead to an economic growth scare. It remains important that growth stays above trend, particularly during a rising interest rate environment. The prospects for economic stability and above-trend growth look favorable, but a strong reacceleration is much less likely. Fortunately, earnings growth expectations for 2022 are in line with this modestly positive outlook, so there is potential for upside surprises as we move through the year.

On a less favorable note, the market continues attempting to price in rapidly evolving expectations for future interest rates. In recent months, the Fed has practically stumbled over itself with one hawkish turn after another. It has signaled a more and more aggressive path for rate increases, as well as an earlier-than-anticipated reduction in the size of its balance sheet – a move toward “quantitative tightening” (QT) expected later this year. This new approach is clearly in response to inflation that has both continued rising and broadening in its scope.

A rise in the “real” rate of interest – i.e., the headline interest rate minus inflation expectations – pressures equities because stock investors discount future earnings using a heftier denominator. The January equity market volatility was largely the result of coming to terms with new real rate expectations. At this point, the bond market expects the Fed to increase short-term interest rates five to six times by the end of 2022. After repeated hawkish surprises, the gun-shy market may now be erring on the side of pricing in a bit too much.

Even on the current trajectory, the actual economic implications of rate hikes and QT shouldn’t have a strong effect until 2023. And, typically, such far-out considerations get priced less aggressively. The present conundrum, however, is that the Fed’s inflation-fighting trajectory for the foreseeable future looks well-enough defined. Recent gyrations are an attempt to price in longer-dated considerations – the farther away the change, the greater the potential for larger price swings. We expect volatility in both directions to remain high until it appears the rate of inflation is noticeably declining, and the Fed has breathing room to break its string of hawkish surprises that have unnerved the market for the past few meetings.

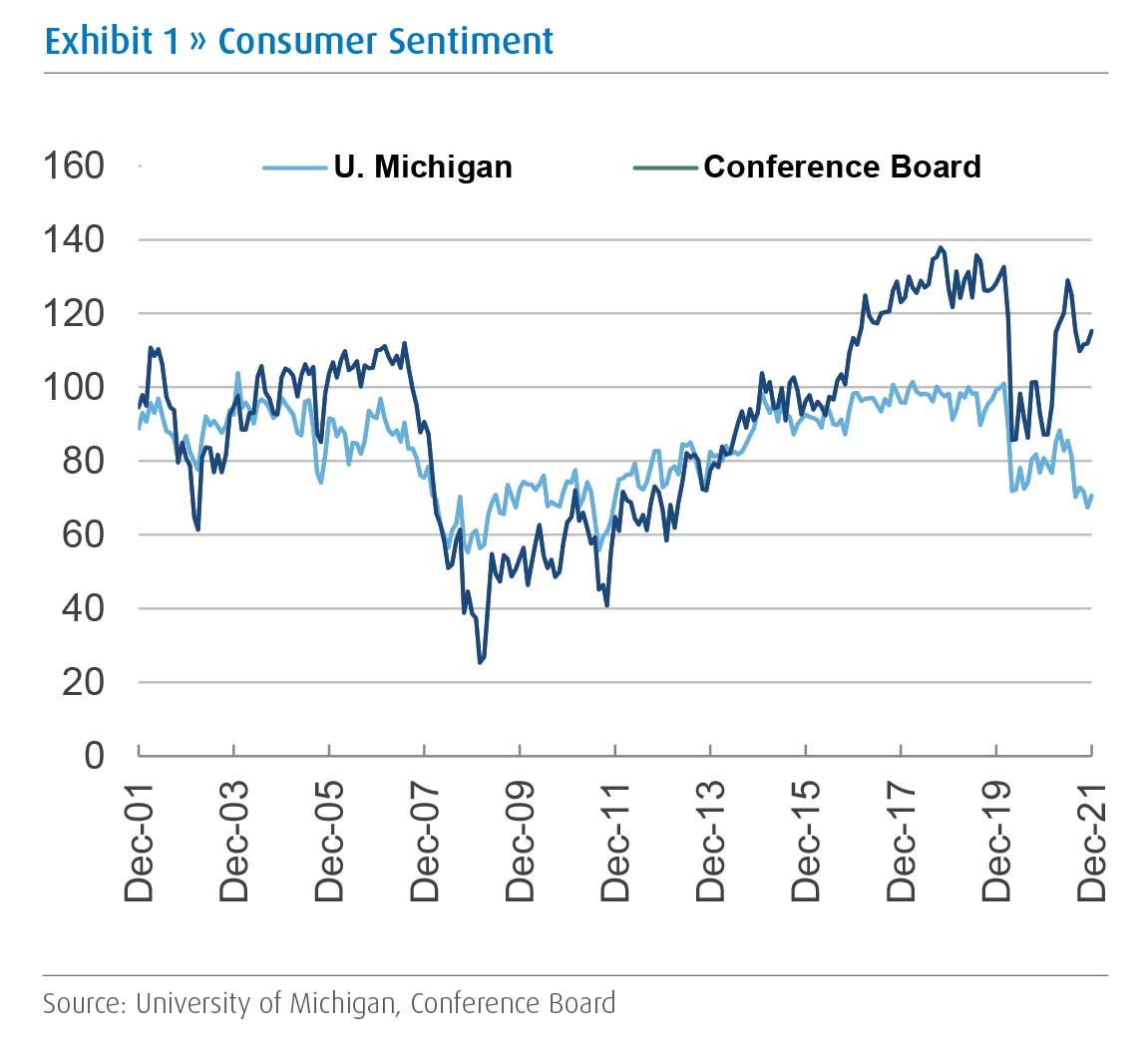

On the inflation front, as Omicron cases fall a shift away from goods spending and toward services would help significantly to soften price pressures in the coming months. Consumer spending may underwhelm if inflation weighs on purchasing patterns. Nonetheless, long overdue inventory rebuilding will provide an economic buffer in the coming quarters and the strong labor market should instill more confidence as we move through the year. These positive effects should offset much of the dampened consumer confidence and spending that high inflation has initiated (Exhibit 1). Overall, we continue to expect inflation pressures will show convincing signs of easing by the summer.

How quickly inflation comes down is a meaningful consideration for interest rate expectations and the easing of market headwinds. Our position is that the natural decline in inflation will afford the Fed breathing room to soften its hawkish stance later this year, but there is risk both in that forecast and the Fed’s assessment of exactly what constitutes a sufficient decline. Interest rates will increase, and monetary conditions will tighten, but the pace and degree is important both for markets and the economy. And the Fed’s history of over-tightening looms large.

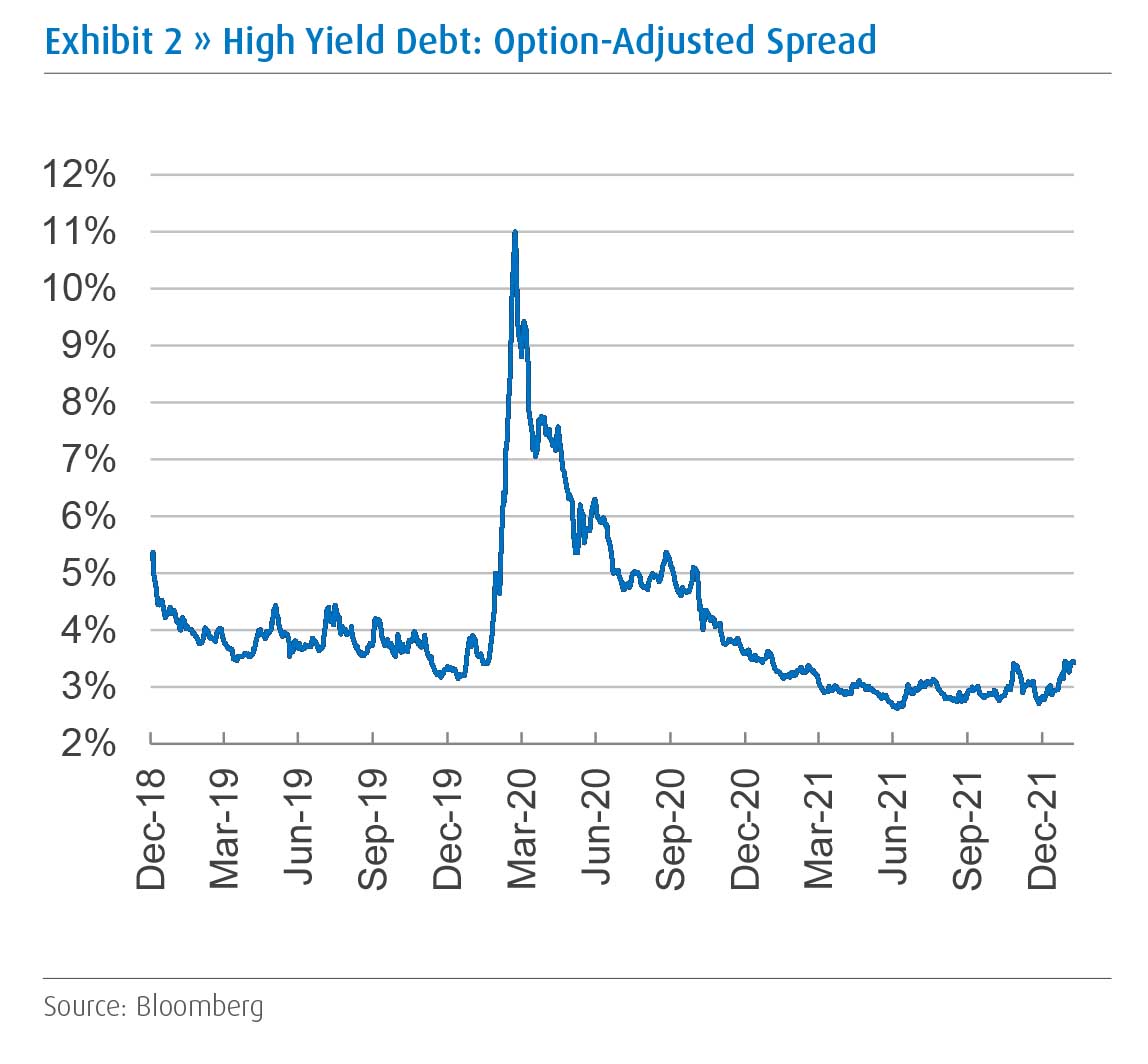

Profit margins will also be in focus this year and analysts have high expectations in this regard. We believe that simply defending existing margins will be the main task at hand, with some small risk to the downside. It’s clear that 2022 is setting up to be a year that requires navigating multiple challenges. The risk-reward for equities is less enticing than last year, but still looks acceptable even if the path is bumpy. Tight credit spreads – even amid the January selloff – continue to point to underlying economic health and a still favorable environment for risk-taking (Exhibit 2).

Finally, much has been made of the steep decline in the Nasdaq as it fell into correction territory to begin the year. We believe the more relevant story, however, is in Small Cap equities which have similarly underperformed. A more durable market will likely be ushered in only when Small Caps have again regained their footing and equity advances are broad-based. As indicated in our 2022 Outlook, it remains a time for reasonable expectations in the equity market . . . the year has just begun and despite a rocky start it is not yet lost.

Stay on top of the latest news and insights from BMO Wealth Management