Looking for something else?

Welcome

Recent market drivers

The markets have been on a bumpy path and the month of September exhibited echoes of 2022 with both stocks and bonds falling in tandem. Longer-term interest rates have marched upward as the intersection of massive Treasury issuance, structural changes, and Fed messaging of higher for longer short-term rates all put upward pressure on the long end of the yield curve. The structural changes pushing long-term rates higher include a tight labor market and an inflation environment that, while improving, is also unlikely to return to levels that prevailed between 2009 and 2020. As the market recalibrates to higher interest rates, it is gradually realizing that the post-2009 Financial Crisis period of low inflation and rock-bottom interest rates was likely the anomaly.

Buffers against a hard landing

Our expectation of a soft landing for the U.S. economy is based on the belief that a healthy labor market and robust infrastructure spending would buffer the negative impact of higher interest rates while inflation gradually fell to acceptable levels. This scenario has played out well to date, but higher short-term and long-term interest rates erode this buffer over time as consumer loans and business loans become more costly and strain budgets.

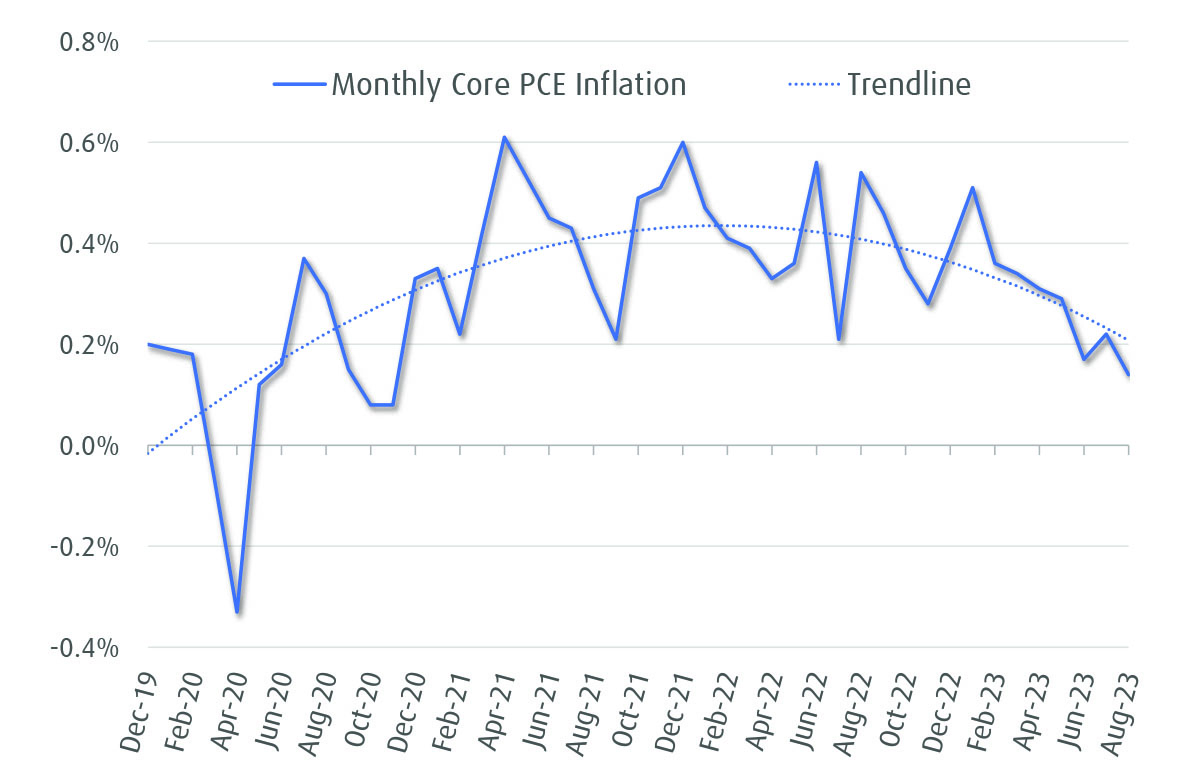

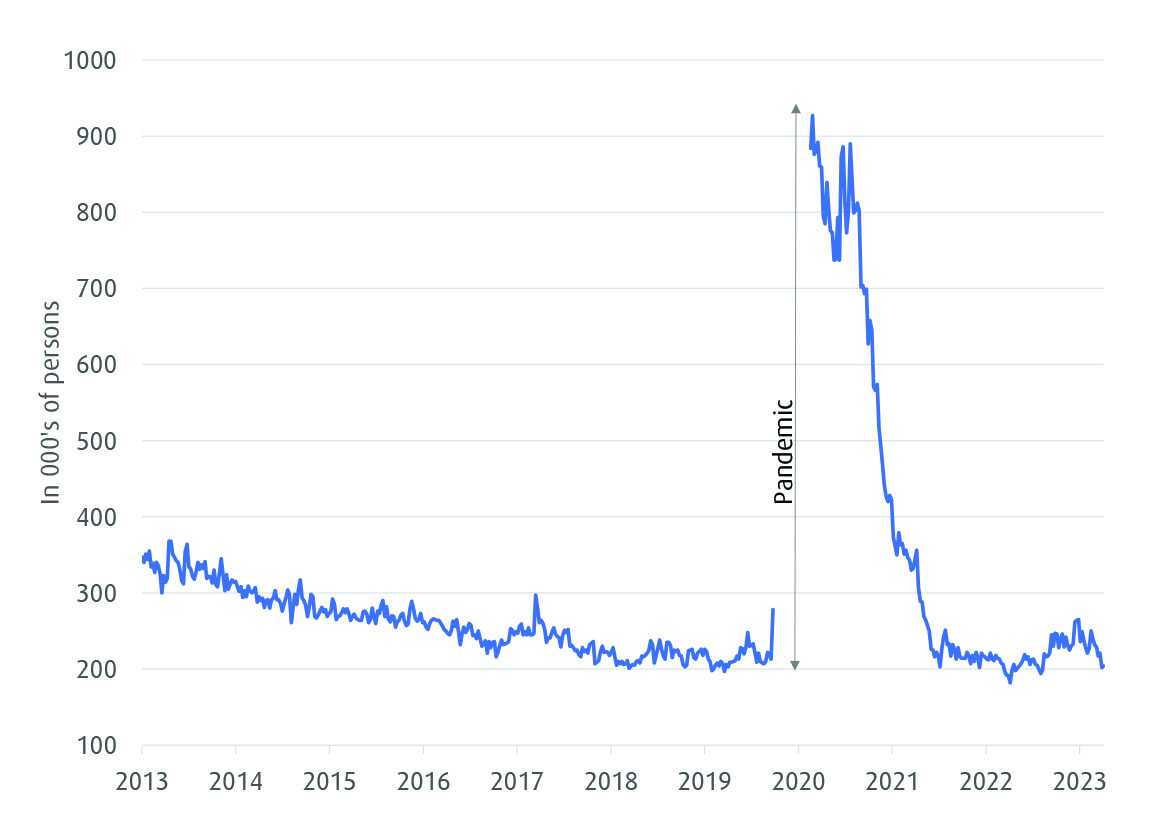

On the positive side, inflation is moderating (Exhibit 1) and the labor market buffer is proving resilient, which is evident in the Weekly Initial Unemployment Claims (Exhibit 2). The Fed’s insistence on 2% target inflation, however, likely means a protracted period of higher interest rates.

Exhibit 1: Core PCE Inflation (monthly change)

Source: Bureau of Economic Analysis (2023), Bloomberg L.P. (2023), BMO Wealth Management (2023)

Exhibit 2: Weekly Initial Unemployment Claims

Source: Department of Labor (2023), Bloomberg L.P. (2023), BMO Wealth Management (2023)

Given this interest rate backdrop, we have been expecting the economy to soften somewhat into year-end and then stabilize as we move through 2024. Gradual stabilization rather than ongoing weakness is more likely given the lack of severe imbalances in the economy. That trajectory, by itself, is not cause for alarm, but when coupled with rising long-term interest rates and newly heightened Fed expectations, the market is proceeding with caution. For now, there is high sensitivity to interest rates and Fed messaging, both of which have been going in a challenging direction recently.

Positioning

The changing landscape presents new risks and opportunities. We continue to have a favorable medium-term outlook for U.S. infrastructure and similarly believe that our recommended allocation to catastrophe bonds exhibits a favorable risk-reward trade-off. Recently, we have also recommended portfolio changes that include additions to short-term U.S. Treasuries and Japanese equities while reducing other areas of greater risk and less opportunity.

The recent climb in long-term yields has been nothing short of destabilizing for markets. We are more focused on the current dynamics playing out rather than on a specific level where we expect long-term yields to settle. Increasing fixed income duration would be primarily an assessment of the current dynamics peaking in intensity and impact. We also recognize that a soft landing cannot be taken for granted in an environment where interest rates and the Fed surprise to the upside, so we continue to assess the trajectory and impacts of those developments. While we expect the economy to slow in the coming months, we also believe that the peak in Fed hawkishness will soon follow, so it is important to recognize that market narratives are prone to shift in the months ahead. We continue to recommend a balanced approach to risk, albeit with a dose of near-term caution.

Stay on top of the latest news and insights from BMO Wealth Management