Looking for something else?

Welcome

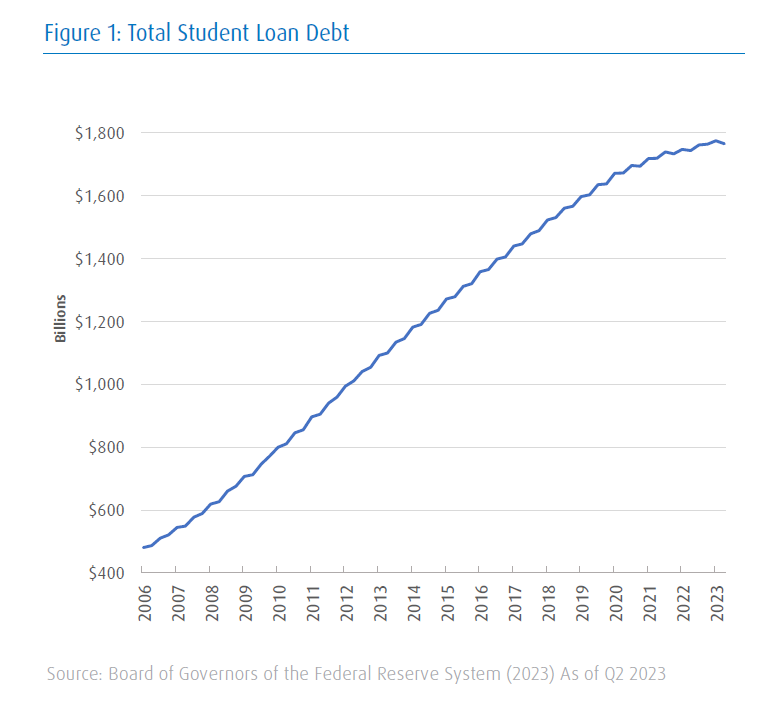

After three and a half years of zero-interest forbearance, federal student loan repayments are set to begin again in October. Total student loan debt is approximately $1.75 trillion (figure 1), and approximately 27 million borrowers with over $1 trillion in student loan debt are currently in pandemic-era forbearance.1 On a relative comparison basis, auto loans total about $1.6 trillion and total credit card debt about $1 trillion.2 Just from those relative magnitudes, it’s clear that the economic impact of this policy change warrants consideration.

Prior to the pandemic, the average payment on student loans approached $400/month, per Federal Reserve data. Our estimates indicate that renewed student loan payments will be equivalent to approximately $9 billion per month, or 0.6% of personal consumption expenditures. We do not, however, expect actual expenditures to dip to that degree as some proportion will come from reduced savings and student loan defaults will rise considerably.

The expected level of economic impact resulting from the removal of this fiscal stimulus is notable but not extreme on a stand-alone basis. The concern, however, is this reduced spending toward year-end and into 2024 will come at a time of economic softness when the impact of Federal Reserve interest rate hikes is constraining the economy. At present, auto loan and credit card loan defaults are already rising and bank lending standards are tightening.

Fortunately, a still-healthy labor market combined with strength in certain segments of the economy continue to provide support to our soft-landing expectation. Recent positive data on retail sales also support this trajectory. If the soft-landing path continues, economic growth could soften for a couple of quarters but would not experience significant downward momentum or a “negative feedback loop” whereby a slowdown begets layoffs, which begets a greater slowdown.

The equity market, as a discounting mechanism, attempts to look past the near-term factors and price in more of a medium-term outlook. We continue to believe that outlook calls for a balanced approach to risk while being vigilant that the resumption of student loan payments represents a removal of fiscal stimulus that adds to the economic headwinds.

______________

1 https://educationdata.org/average-student-loan-debt

2 Fred site for auto loans - https://fred.stlouisfed.org/series/MVLOAS - Date Q2 2023

Fred site for credit card loans - https://fred.stlouisfed.org/series/CCLACBW027SBOG - Date Aug 2023

Stay on top of the latest news and insights from BMO Wealth Management